PC Jeweller Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

The Gems & Jewellery industry |

58.55 |

|

|

1 year |

PC Jeweller Limited - Company Profile

Incorporated on 13th April 2005 as a private limited company under the name P Chand Jewellers Private Limited, PC Jeweller Limited is a jewelry company. On 16th October 2007, the name of the company was changed to PC Jewellers Private Limited and PC Jeweller Private Limited on December 9, 2009. The Company is committed in the business of manufacture, retail and export of jewelry. It offers a range of products including certified diamond jewelry, 100% hallmarked gold jewelry and other jewelry which includes silver articles that focus mainly on diamond jewelry and jewelry for weddings. Online sale portal www.wearyourshine.com is primarily used to sell the products. Its jewelry category includes mangalsutras, earrings, rings, pendants, chains and necklaces, bangles and bracelets, and nose pins. Apart from the mentioned, they also offer platinum, gemstone, men's and kids jewelry.

PC Jeweller Limited - Investment Summary

|

CMP (Rs) |

59.20 |

|

52 Week H/L |

600.65/46.85 |

|

Market Cap (Cr) |

2,334.34 |

|

Equity Cap (Cr) |

394.36 |

|

Face Value (Rs) |

10.00 |

|

Promoter Holding (%) |

50.70 |

|

Non-Promoter Holding (%) |

49.30 |

|

Total (%) |

100.00 |

-

Established brand

-

Network of strategically located large-format showrooms

-

Wide product range with an increasing focus on diamond jewellery

-

Significant manufacturing capabilities

PC Jeweller Limited - Financial Summary

|

Particulars(Rs.Cr) |

Mar 14 |

Mar 15 |

Mar 16 |

Mar 17 |

Mar 18 |

|

|

Total Assets |

4,232.55 |

4,711.51 |

5,748.23 |

7,217.08 |

8,960.98 |

|

|

Total Revenue |

6,407.71 |

7,308.63 |

8,208.59 |

9,584.46 |

9,584.46 |

|

|

Profit after Tax |

378.23 |

400.88 |

430.53 |

567.40 |

567.40 |

|

|

EPS( Rs) |

21.12 |

22.38 |

12.03 |

14.94 |

14.94 |

|

PC Jeweller Limited - Outlook and Valuation

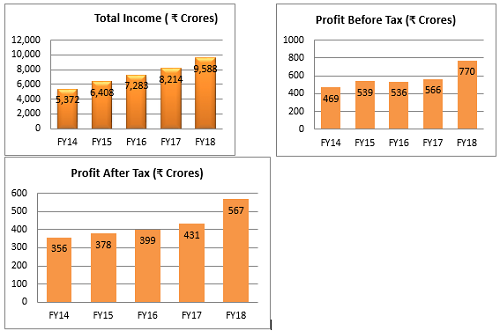

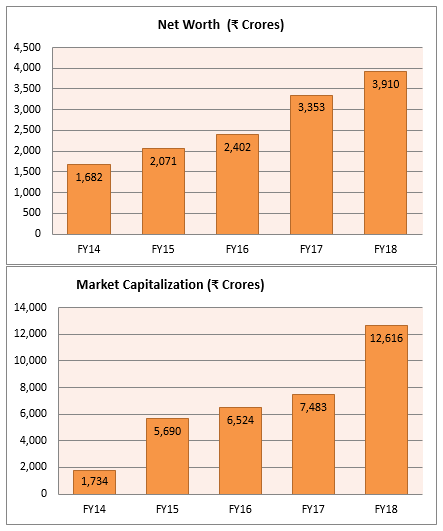

The company has put up its best-ever financial performance in FY18. The company recorded growth of 17.2% of topline, 26% in EBIDTA, and an impressive 31.8% in Net Profits, on a Year-On-Year basis. During the year, revenue from operations of the Company on a standalone basis grew by 17% to ₹ 9,489 crores. The net profit after tax also registered a growth of 32% to ₹ 567 crores. The share of domestic and export sales in the revenue from operations on a standalone basis is ₹6,799 crores (72%) and ₹ 2,690 crores (28%) respectively. However, during the last few months, there is news about company officials allowing promoters to sell by gifting shares to undisclosed relatives, which in turn, buffeted the stock. Allegations about PCJ's undisclosed business ties with Vakrangee, which is under SEBI probe for alleged price and volume manipulation, have further worried investors and cancellation of Buyback plan, these are the major reasons for the falling share prices rapidly. They haven’t found the reason for the fall of shares, which creates more doubts for the investors.

PC Jeweller Limited - Management Profile

|

Key Personnel |

Designation and Experience |

Auditors |

|

Mr. Padam Chand Gupta |

Chairman: Mr. Padam Chand Gupta serves as the Chairman of the Board and is the Founder at PC Jeweller Limited. Mr. Gupta has been a Non-Executive Director of PC Jeweller Limited since April 2005. Mr. Gupta has been an Independent Non-Executive Director of Haryana Texprints (Overseas) Limited since September 29, 2014.

|

|

|

Mr. Balram Garg |

Managing Director: Mr. Balram Garg, B.Com. Has been the Managing Director at PC Jeweller Ltd since April 16, 2005 and serves as its Chief Executive Officer. Mr. Garg has been an Executive Director of PC Jeweller Limited since July 01, 2011. Mr. Garg holds a bachelor’s degree in commerce from the University of Delhi.

|

|

|

Mr. Manohar Lal Singla |

Independent Director: Manohar Lal Singla is on the board of PC Jeweller Ltd. and Professor at Faculty of Management Studies. He received an undergraduate degree from Panjab University Chandigarh and an MBA and a doctorate from the University of Delhi

|

|

|

Mr. Ramesh Kumar Sharma |

Chief Operating Officer: Mr. Ramesh Kumar Sharma is Chief Operating Officer & Executive Director at PC Jeweller Ltd. He is on the Board of Directors at PC Jeweller Ltd. He received his undergraduate degree from the University of Rajasthan and a graduate degree from the University of Rajasthan. |

|

|

Mr. Krishan Kumar Khurana |

Independent Director: Krishan Kumar Khurana is on the board of PC Jeweller Ltd. He received a graduate degree from Kurukshetra University and an undergraduate degree from the University of Delhi. |

|

PC Jeweller Limited - Company overview:

PC Jeweller Ltd is one of the leading jewelry companies in India. The company offers an extensive variety of products including gold adornments, precious stone gems, and other gems with a push on diamond jewelry and jewelry for weddings. The Company has 92 showrooms in 73 cities. One of the leading jewelry brands in the country, PCJ houses diverse collections in varieties of diamond, stones, gold, Polki, and Kundan. Known for their contemporary designs and innovations, their showrooms are laced with their best collections for weddings and special occasions. PC Jeweller also has significant jewelry manufacturing capabilities that cater to their sales in India and abroad.

In addition to the sale of jewelry through its showrooms, the company also sells gold and diamond jewelry through online sales on its website. They also export gold and diamond jewelry on a wholesale basis to international distributors in Dubai and Hong Kong. The Company operates in different geographical areas i.e. domestic sales and export sales. The share of domestic sales and export sales in the revenue from operations on a standalone basis is INR 6,799 crores (72 percent) and INR 2,690 crores (28 percent) respectively. Further, the share of domestic sales and export sales in the profit before tax and interest on a standalone basis is INR 860 crores (80 percent) and INR 215 crores (20 percent) respectively.

The company was listed on August 2, 2011, following which the name was changed to PC Jeweller Limited. During 2013, the company has invested Rs 175 crore to buy gold and diamond jewelry stocks for six new retail outlets and proposes to infuse another Rs 225 crore next quarter for further expansion.

During 2014, the company has incorporated a new wholly owned subsidiary namely Transforming Retail Private Limited. During 2015, the company signed deal with Blue Nile Inc, a leading online jeweller in the US, and also opened its 54th showroom and first in Yamuna Nagar. In 2014-15, PC Jeweller launched WearYourShine.com, its online retail store.

In 2015-16, PC Jeweller launched its 60th showroom in Udaipur, Rajasthan. In 2016-17, PC Jeweller launched its 75th showroom at Alwar, Rajasthan. On 30 March 2017, PC Jeweller informed the stock exchanges that the encumbrance created on shareholdings of promoters and members of the promoter group due to Non Disposal Undertaking in terms of the Investment Agreement dated 18 April 2016 entered into by PC Jeweller with DVI Fund (Mauritius) Ltd and the Sponsors Agreement dated 28 April 2016, stands released with effect from 30 March 2017. After this release, no shares held by the company’s promoters or members of the promoter group are under any pledge/lien/non disposal undertaking.

Key Ratios

|

Key Ratios |

FY18 |

FY17 |

FY16 |

FY15 |

FY14 |

|

Debt-Equity Ratio |

0.27 |

0.27 |

0.21 |

0.40 |

0.34 |

|

Current Ratio |

1.71 |

1.71 |

1.75 |

1.63 |

1.66 |

|

Inventory Turnover Ratio (x) |

1.84 |

1.84 |

1.97 |

1.88 |

1.97 |

|

Total Asset Turnover Ratio (%) |

105.85 |

105.85 |

112.22 |

126.28 |

134.74 |

|

PBDIT Margin (%) |

11.51 |

11.51 |

10.65 |

10.68 |

12.33 |

|

PBIT Margin (%) |

11.29 |

11.29 |

10.38 |

10.37 |

11.97 |

|

ROCE (%) |

14.32 |

27.04 |

24.51 |

16.77 |

18.9 |

|

RONW (%) |

14.45 |

14.45 |

12.78 |

17.22 |

19.00 |

|

Payout (%) |

30.52 |

29.41 |

31.30 |

34.25 |

31.41 |

|

Price/Book Value (x) |

3.21 |

3.21 |

2.22 |

2.81 |

2.86 |

|

EV/EBITDA (x) |

11.14 |

11.14 |

8.39 |

9.27 |

7.79 |

|

Market Cap/Sales |

1.33 |

1.33 |

0.92 |

0.90 |

0.90 |

PC Jeweller Limited - Investment Rationale

-

Established brand

PC Jeweller has made a remarkable journey so far and has created a brand of its own with sustainable customer initiatives and unrivalled quality that loyal customers vouch for. With contemporary and classic designs aimed for longevity, we are committed to providing you the best buying experience using a collaborative approach across both online platform and showrooms. They have made significant investments in nationwide advertising campaigns and event sponsorships to promote our brand. In 2016, PC Jeweller Ltd has acquired bridal jewellery brand “Azva” from the World Gold Council for an undisclosed amount.

-

Network of strategically located large-format showrooms

The Company continues to focus on expanding its retail presence across the Country. The Company has three types of showrooms i.e. large format, small format and franchisee. As on March 31, 2018, the Company has 92 showrooms, out of which 82 showrooms are Company owned and remaining 10 are franchisee showrooms across 73 cities in India with an aggregate area of approximately 4,19,963 sq.ft. They follow a detailed showroom selection methodology. Company believe that their large-format showrooms, located strategically in “high street” areas with high visibility and customer traffic, provide their customers with a luxury retail experience, which reinforces our positioning as a trusted jewellery retailer. PC Jewellery believe that their large format showrooms also enable them to offer a wide range of jewellery products attracting a diverse customer base, ensure effective inventory management and provide benefits of scale.

-

Wide product range with an increasing focus on diamond jewellery

The company’s wide range of product offerings caters to diverse customer segments, from the value market to high-end customized jewellery. The company’s product includes traditional, contemporary and combination designs across jewellery lines, usages and price points. The main business of the company is in the sale of wedding jewellery, which is responsible for a bulk of its profits. In this segment the company has continued to increase the focus on diamond jewellery, as it commands higher profit margins than other types of jewellery. As gold prices have gone up tremendously, it has become out of reach for the middle class to buy gold jewellery. Here the company has opened the market for diamond jewellery, which is just opening up and showing immense growth potential.

-

Significant manufacturing capabilities

A significant portion of the company’s jewelry is designed and manufactured at their own manufacturing facilities. This enables them to control costs, helps in increasing profit margins, and gives them a competitive advantage over some of their competitors who do not have their own manufacturing facilities. The company has established two jewelry manufacturing facilities at Selaqui, Dehradun, Uttarakhand to increase their sales in India. They have also set up two jewelry manufacturing facilities at the Noida SEZ, Uttar Pradesh, for their export sales. Overall they have 5 manufacturing units in India. The company’s large skilled workforce with knowledge and expertise in jewelry-making is a key competitive strength that has enabled them to establish their reputation and brand.

Industry Overview

Given its dual utility of improving aesthetics as well as investment, the Gems & Jewellery industry has acquired prominence over the years in the country. Contributing around 7% of the country’s GDP and 15.71% to India’s total merchandise exports, the Gems & Jewellery sector plays a significant role in the Indian economy. It is extremely export-oriented and labor-intensive, which makes them one of the fastest-growing sectors.

Because of its low costs and availability of high-skilled labor, India is deemed to be the hub of the global jewelry market. India and China are the largest buyers as well as the prominent manufacturers of gold jewelry in the world. Being the largest player in diamond cutting and polishing, 12 out of 14 diamonds sold in the world are either polished or cut in India. Gold jewelry manufactured in India, a major chunk is for domestic consumption, whereas a major portion of polished diamonds or finished diamond jewelry is exported. As per statistics from the Gems and Jewellery Export Promotion Council (GJEPC), India exports 75% of the world’s polished diamonds. In a big way to the country’s foreign exchange earnings (FEEs), India’s Gems and Jewellery sector has been contributing. The biggest importers of Indian jewelry are UAE, the US, Russia, Singapore, Hong Kong, Latin America, and China. The Government of India has declared the Gems and Jewellery sector as a focus area for export promotion based on its potential for growth and value addition. To promote ‘Brand India’ in the international market, the Government has recently undertaken various measures to promote investments and to upgrade technology and skills. Through the automatic route, the Indian government presently allows 100% Foreign Direct Investment (FDI) in the sector. As per Department of Industrial Policy and Promotion (DIPP), the cumulative FDI inflows in the diamond and gold jewellery sector are USD 1,111.52 million as of December 2017.

The Gems & Jewellery market comprises the following:

-

Diamond studded jewellery

-

Gold jewellery

-

Silver jewellery, and

-

Precious and semi-precious gemstones and its jewellery.

Investments/Developments

Due to adoption of western lifestyle, the Gems and Jewellery sector is witnessing changes in consumer preferences. Branded jewellers are able to fulfill consumers changing demands better than the local unorganized players by providing new designs and varieties in jewellery. Since jewellery is a status symbol in India, there is an increase in per capita income which has led to an increase in sales of jewellery.

According to Department of Industrial Policy and Promotion (DIPP), the cumulative Foreign Direct Investment (FDI) inflows in diamond and gold ornaments in the period from April 2000 to June 2018 were US$ 1.15 billion.

Some of the key investments in this industry are listed below.

-

During the show held in August 2018, deals worth Rs 8,000 crore (US$ 1.19 billion) were made at the Indian International Jewellery.

-

A virtual-reality (VR) experience will be designed for the consumers by the companies such as PC Jewellers, PNG Jewellers, Popley and Sons. This will help the customer to select and see the jewellery from different angles and zoom on it to view intricate designs by wearing a VR headset.

Government Initiatives

-

To avoid the parking of black money in bullion, the Government of India would notify a new limit for reporting about transactions in gold and other precious metals and stones to authorities.

-

From January 2018 to ensure a quality check on gold jewellery, the Bureau of Indian Standards (BIS) has revised the standard on gold hallmarking in India. The hallmark on gold jewellery will now carry a BIS mark, purity in carat and fitness as well as the unit’s identification and the jeweller’s identification mark.

-

A Common Facility Center (CFC) will be set up by the Government of India at Thrissur, Kerala.

-

To build India’s largest jewellery park in at Ghansoli in Navi-Mumbai, the Gems and Jewellery Export Promotion Council (GJEPC) signed a Memorandum of Understanding (MoU) with Maharashtra Industrial Development Corporation (MIDC). With an overall investment of Rs 13,500 crore (US$ 2.09 billion), the park will be on a 25 acres land with about more than 5000 jewellery units of various sizes ranging from 500-10,000 square feet.

Peer Review

|

Name |

Last Price |

Market Cap. |

Sales Turnover |

Net Profit |

Total Assets |

|

Rajesh Exports |

565.35 |

16,692.52 |

33,659.82 |

441.18 |

12,744.7 |

|

Vaibhav Global |

657.30 |

2,144.03 |

470.02 |

30.79 |

610.28 |

|

PC Jeweller |

48.40 |

1,910.10 |

9,485.50 |

567.40 |

4,980.27 |

|

Thangamayil |

379.10 |

520.11 |

1,380.85 |

22.87 |

359.02 |

|

Renaissance Jew |

265.85 |

501.91 |

1,022.21 |

29.92 |

646.04 |

|

Tribhovandas |

52.95 |

353.34 |

1,751.41 |

21.05 |

1,055.31 |

Profit and Loss

|

FY18 |

FY17 |

FY16 |

FY15 |

FY14 |

|

|

INCOME |

|||||

|

Revenue From Operations [Gross] |

9,488.97 |

9,485.50 |

8,104.58 |

7,259.07 |

6,348.52 |

|

Less: Excise/Sevice Tax/Other Levies |

3.47 |

0.00 |

5.14 |

0.00 |

0.00 |

|

Revenue From Operations [Net] |

9,485.50 |

9,485.50 |

8,099.44 |

7,259.07 |

6,348.52 |

|

Total Operating Revenues |

9,485.50 |

9,485.50 |

8,099.44 |

7,259.07 |

6,348.52 |

|

Other Income |

98.96 |

98.96 |

109.15 |

49.56 |

59.19 |

|

Total Revenue |

9,584.46 |

9,584.46 |

8,208.59 |

7,308.63 |

6,407.71 |

|

Revenue From Operations [Gross] |

9,488.97 |

9,485.50 |

8,104.58 |

7,259.07 |

6,348.52 |

|

EXPENSES |

|||||

|

Cost Of Materials Consumed |

8,830.81 |

8,830.81 |

7,220.88 |

6,646.16 |

6,405.38 |

|

Purchase Of Stock-In Trade |

318.08 |

318.08 |

188.76 |

4.04 |

2.96 |

|

Changes In Inventories Of FG,WIP And Stock-In Trade |

-1,006.42 |

-1,006.42 |

-337.28 |

-405.44 |

-1,026.01 |

|

Employee Benefit Expenses |

89.69 |

89.69 |

78.60 |

70.17 |

55.55 |

|

Finance Costs |

301.29 |

301.29 |

274.71 |

214.65 |

220.87 |

|

Depreciation and Amortization Expenses |

20.46 |

20.46 |

22.01 |

22.61 |

23.02 |

|

Other Expenses |

260.38 |

260.38 |

194.51 |

217.77 |

186.62 |

|

Total Expenses |

8,814.29 |

8,814.29 |

7,642.19 |

6,769.96 |

5,868.39 |

|

Profit/Loss Before Exceptional, Extraordinary Items and Tax |

770.17 |

770.17 |

566.40 |

538.67 |

539.32 |

|

Profit/Loss Before Tax |

770.17 |

770.17 |

566.40 |

538.67 |

539.32 |

|

Tax Expenses-Continued Operations |

|||||

|

Current Tax |

198.65 |

202.77 |

121.69 |

160.68 |

162.47 |

|

Deferred Tax |

4.12 |

0.00 |

14.18 |

-3.87 |

-1.38 |

|

Total Tax Expenses |

202.77 |

202.77 |

135.87 |

137.79 |

161.09 |

|

Profit/Loss After Tax And Before Extraordinary Items |

567.40 |

567.40 |

430.53 |

400.88 |

378.23 |

|

Profit/Loss From Continuing Operations |

567.40 |

567.40 |

430.53 |

400.88 |

378.23 |

|

Profit/Loss For The Period |

567.40 |

567.40 |

430.53 |

400.88 |

378.23 |

|

Current Tax |

198.65 |

202.77 |

121.69 |

160.68 |

162.47 |

|

Deferred Tax |

4.12 |

0.00 |

14.18 |

-3.87 |

-1.38 |

|

EARNINGS PER SHARE |

|||||

|

Basic EPS (Rs.) |

14.94 |

14.94 |

12.03 |

22.38 |

21.12 |

|

Diluted EPS (Rs.) |

14.73 |

14.73 |

11.31 |

22.34 |

21.12 |

PC Jeweller Limited - Balance Sheet

|

FY18 |

FY17 |

FY16 |

FY15 |

FY14 |

|

|

EQUITIES AND LIABILITIES |

|||||

|

SHAREHOLDER'S FUNDS |

|||||

|

Equity Share Capital |

394.36 |

179.14 |

179.10 |

179.10 |

179.10 |

|

Total Share Capital |

394.36 |

179.14 |

179.10 |

179.10 |

179.10 |

|

Reserves and Surplus |

3,531.44 |

3,187.64 |

2,148.30 |

1,811.28 |

1,503.16 |

|

Total Reserves and Surplus |

3,531.44 |

3,187.64 |

2,148.30 |

1,811.28 |

1,503.16 |

|

Total Shareholders’ Funds |

3,925.80 |

3,366.78 |

2,327.40 |

1,990.38 |

1,682.26 |

|

NON-CURRENT LIABILITIES |

|||||

|

Long Term Borrowings |

29.50 |

57.70 |

58.23 |

0.41 |

0.41 |

|

Deferred Tax Liabilities [Net] |

0.00 |

0.00 |

0.00 |

0.00 |

8.88 |

|

Other Current Liabilities |

410.88 |

344.63 |

111.19 |

49.62 |

163.56 |

|

Short Term Provisions |

2.23 |

0.88 |

194.63 |

177.89 |

97.43 |

|

Total Current Liabilities |

4,999.26 |

3,786.45 |

3,358.29 |

2,717.85 |

2,548.11 |

|

CURRENT LIABILITIES |

|||||

|

Short Term Borrowings |

1,024.97 |

633.97 |

881.90 |

680.97 |

1,002.99 |

|

Trade Payables |

3,561.18 |

2,806.97 |

2,170.57 |

1,809.37 |

1,284.12 |

|

Other Current Liabilities |

410.88 |

344.63 |

111.19 |

49.62 |

163.56 |

|

Short Term Provisions |

2.23 |

0.88 |

194.63 |

177.89 |

97.43 |

|

Total Current Liabilities |

4,999.26 |

3,786.45 |

3,358.29 |

2,717.85 |

2,548.11 |

|

Total Capital And Liabilities |

8,960.98 |

7,217.08 |

5,748.23 |

4,711.51 |

4,232.55 |

|

ASSETS |

|||||

|

NON-CURRENT ASSETS |

|||||

|

Tangible Assets |

77.30 |

83.67 |

89.88 |

89.58 |

83.93 |

|

Intangible Assets Under Development |

0.00 |

0.00 |

0.00 |

0.00 |

1.10 |

|

Fixed Assets |

77.30 |

83.67 |

89.88 |

89.58 |

85.03 |

|

Non-Current Investments |

133.93 |

133.93 |

0.07 |

0.06 |

0.05 |

|

Deferred Tax Assets [Net] |

18.92 |

29.51 |

16.39 |

12.52 |

10.73 |

|

Long Term Loans And Advances |

129.50 |

305.75 |

170.53 |

84.03 |

87.59 |

|

Other Non-Current Assets |

34.47 |

34.14 |

5.07 |

3.28 |

9.19 |

|

Total Non-Current Assets |

394.12 |

587.00 |

281.94 |

189.47 |

192.58 |

|

CURRENT ASSETS |

|||||

|

Current Investments |

18.63 |

9.40 |

7.38 |

13.12 |

184.95 |

|

Inventories |

5,161.28 |

4,118.64 |

3,871.08 |

3,229.85 |

2,377.13 |

|

Trade Receivables |

1,761.81 |

1,274.40 |

908.22 |

767.53 |

623.22 |

|

Cash And Cash Equivalents |

1,491.47 |

931.65 |

286.43 |

274.11 |

330.09 |

|

Short Term Loans And Advances |

32.11 |

22.73 |

368.24 |

228.76 |

516.77 |

|

Other Current Assets |

101.56 |

273.26 |

24.94 |

8.67 |

7.82 |

|

Total Current Assets |

8,566.86 |

6,630.08 |

5,466.29 |

4,522.05 |

4,039.97 |

Stock Performance Chart

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.