KRBL

KRBL Limited - Background

KRBL Limited, formerly known as Khushi Ram Behari Lal, was founded in 1889 and is based in Gautambudh Nagar, India. It is an India based rice millers and basmati rice exporters. The Company operates in two divisions, which includes Agri and Energy. The Agri division is engaged in agricultural commodities, such as rice, Furfural, seed, bran and bran oil. The Energy division is engaged in power generation from wind turbine and husk-based power plant.

KRBL Limited - Investment Rationale

-

Increase in demand to aid growth

-

Change in demographic pattern

-

No threat of substitutes

-

Market leader and wide reach

-

Sound financials

|

Key Parameters |

|

|

BSE Code |

53081333 |

|

NSE Code |

KRBL |

|

Reuters Code |

KRBL.BO |

|

CMP (as on 12/08/2015) |

186.00 |

|

Stock Beta |

1.82 |

|

52 Week H/L |

199.90/80.00 |

|

Market Cap (Cr) |

4417 |

|

Equity Capital (Rs cr) |

23.54 |

|

Face Value (Rs) |

1 |

|

Average Volume |

190392 |

|

|

|

|

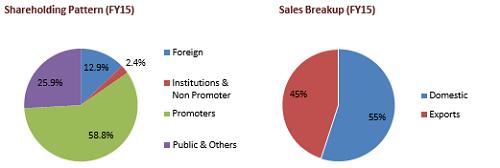

Shareholding Pattern (%) |

|

|

Promoters |

58.81 |

|

Non Institutions |

41.19 |

|

Grand Total |

100 |

KRBL Limited - Risks and Concerns

-

Competition from unorganized sector

-

Seasonal and climatic uncertainties

-

Forex fluctuations

Conclusion & Recommendation

KRBL being the largest player in domestic and international basmati market with its high quality products and wide market reach in both India and abroad. Backward integration helps the company to reduce the cost expenses to the minimum and company is in a good position to capitalize on the market demands with its capacities and we expect company to outperform the industry in the both short term and long term future.

At the current market price of Rs.186 the stock is trading at 10x FY17E EPS. Investors could buy the stock at CMP and add on dips to around Rs.172 to Rs.175 levels (~9.5x FY17E EPS) for our sequential targets of Rs.208 and Rs.223 (~11x to ~12.5x FY17E EPS).

KRBL Limited - Financial Summary

|

Particulars (Rs. in Crs) |

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

Net Sales |

2080.39 |

2910.46 |

3159.69 |

3986.57 |

4525.65 |

|

Operating Profit |

312.29 |

460.11 |

527.68 |

669.85 |

763.53 |

|

PAT |

129.86 |

255.11 |

321.73 |

354.84 |

434.24 |

|

EPS (Rs.) |

5.52 |

10.84 |

13.67 |

15.07 |

18.45 |

|

PE |

33.72 |

17.16 |

13.61 |

12.34 |

10.08 |

Company Profile

Agri Business

This business constitutes revenues generated from basmati rice, bran & bran oil and others (including non-basmati rice) which have contributed ~91%, ~2% and ~6%, respectively to the total revenues. KRBL’s rice business has a strong foothold in both the domestic and international market and enjoys wider product reach and acceptance with variety of consumer packs. KRBL holds a significant market share in the total domestic branded basmati rice.

Energy Business

KRBL is engaged in wind and biomass power generation. It has a total installed capacity of 40.6 MW with 26.6 MW of wind power and 14 MW of bio-mass power from husk, a by-product of rice. Located in Dhuri, Punjab and Ghaziabad, UP the energy generated from biomass power plants are primarily used for captive purposes. Wind power capacities are located in Dhulia, Maharashtra, Jodhpur, Rajasthan and Tamil Nadu. Revenue contribution from energy business is expected to improve with the installation of additional capacities of wind power, better utilization of biomass plant at Dhuri, Punjab and earning from clean development mechanism (CDM) carbon credits. Its power plants at Ghaziabad and Dhulia have already become eligible for carbon credits.

Reach & Access

KRBL has been procuring its raw material in two ways through contact farming and from mandis. It covers 182 purchase centers located across five major basmati paddy growing states including Punjab, Haryana, UP, J&K and Uttaranchal. KRBL has a strong distribution network with presence across 28 states domestically with over 480 nationwide distributors, who in turn have access to over four lakh retailers. Further, KRBL exports basmati rice to over 27 countries across regions like Middle East, Iran, Europe, US and West Asia. The company has strong collaborations with large retail chains like Reliance Fresh, D Mart, Big Bazaar, Spencer’s, Aditya Birla-More, Hypercity in the domestic market and; Carrefour, Fiesta, 4 Square, Giant, Shop Rite, New World, Lulu, Woolworths etc in the international market.

Seed development

Quality of the crop largely depends on the quality of the seed. KRBL is making conscious efforts to preserve and enrich the genetic integrity of seeds. It has established a special 300 hectare (741 acre) seed farm and a seed grading plant. It sources ‘breeder’ seeds from various leading Indian Agriculture Research Institutes, which are then grown as ‘foundation’ seeds under the supervision of scientists and the government seed certification agency, before being distributed to farmers. Extensive field trials have revealed a 12 percent increase in the yield of certified seeds. The crops were found to be healthier and free from scourges like blast and blight. Furthermore, the need for nitrogen fertilizers was reduced. KRBL have also entered into Seed Development & Multiplication (QSDIP program), wherein KRBL has established a committed wing of eminent agriculture scientists to conduct research & develop pedigree seeds in line with farmer and market demand.

Brands

Brands India Gate, the flagship brand of the company, is amongst the country’s largest selling brand. Some of its other popular brands include Doon, Nurjahan, Indian Farm, Bemisal, Aarati and Unity. Overall branded rice sales accounted for ~97% of the KRBL’s revenues Feast Rozzana, a new variant of India Gate; mainly targeted to the price sensitive consumer segment.

Contract farming

The meticulous process of Contract Farming involved hand-holding the farmer every step of the way. KRBL distributes high quality seeds, transmitting optimum sowing and transplanting techniques as well as timing, to assisting in sourcing good quality inputs. This program has been an effort to sustain a mutually rewarding public-private partnership and the result has been record growth in the program year on year basis. Looking to the success of the program KRBL plan to increase our land under Contract Farming from 1,60,000 acres to 2,50,000 acres. Having built a relationship of trust over the years, KRBL, today associated with 70,000 farmer families and 65 dedicated farm extension workers.

Procurement

A strong relationship with the farmers through Contract Farming differentiates KRBL from our competitors. The Agri-Service Division works closely with the farmers during each life-cycle of the crop, from sowing and re-plantation to harvesting and threshing, thereby ensuring procurement according to the desired standard. Because paddy quality varies from district to district, and from year to year, KRBL closely monitors the harvest at the start of the season. So, just when the season’s first paddy starts arriving in the markets, a team of rice experts along with a network of Artis (commission agents) is at hand to sample, test, and grade the harvest. This enables KRBL to identify and source the season’s best paddy. It is well placed in terms of procuring paddy from the farmers. The company has taken various initiatives for the regular availability of paddy like contact farming, timely payment to the farmers in cash instead of credit, advance payment for procurement requirements for the year next, educating the farmers about the right methods of rice cultivation. This will also help to create goodwill for the company.

Warehousing

At KRBL, the paddy purchased in a season is kept in storage for a minimum of one year and then is shipped out over a span of the next year. Huge warehousing space is required with the most hygienic storage conditions, ongoing fumigation, and safe custody of cargo. With a warehousing capacity of over 5 million sq. feet equipped with comprehensive systems that ensure maximum protection from ground, moisture, humidity, bird droppings, rodents, and infestation through micro-organisms and insects, KRBL is clearly a cut above our competitors. Currently, KRBL has the capacity to store 6, 00,000 MT of rice and paddy at any given time, valued at over USD 500 million.

Milling

KRBL has the capacity to mill 195 MT per hour of paddy via its various plants in the basmati producing belt. Large-scale operations not only deliver consistently but negate any chances of external rice trading, thereby eliminating contamination of KRBL rice with aflatoxin or microbiological agents. Paddy milling plants are located in Punjab and Uttar Pradesh which strategically cover the northernmost and southernmost tip of Basmati land. Small grading and polishing stations supported by our procurement network across Punjab, Haryana, Uttaranchal, and Uttar Pradesh enable us to handle gigantic proportions of paddy in the short harvesting period of basmati. All plants mill both raw and parboiled basmati and are fully equipped with state-of-the-art machinery to ensure consistency in every grain. It also produces husk-fuelled power in plants as its commitment to the environment and stakeholders alike.

Value-added products

It also produces value-added products such as cattle feeds, power, fuel additives, edible oil, and seeds of high-quality grains.

Investment Rationale

Increase in demand to aid growth

Being the largest producer of branded basmati rice in India, KRBL will be able to capitalize on the increase in demand or sales of basmati in India or abroad with its current manufacturing and process capacities as the current capacity utilization stands at ~65%, which means with increase in sales there can be significant increase in margins from the current levels of ~14% to ~16%.

Change in demographic pattern

India with its fast economic growth and highly favorable demographic pattern along with increase in brand consciousness, brand awareness, increase in health and diet awareness and ever changing shopping culture will work in favor of KRBL because of its already well established brands in basmati market with high-quality products.

No threat of substitutes

Basmati rice being a staple food in major parts of India and certain countries in Africa, Middle East, Europe, US, and West Asia, KRBL with its well-established brands and wide reach into all major markets will be in a position to capitalize on the demand of the rice and increase its revenue and profit margins. The government is going to provide intellectual property rights (IPR) protection to basmati producers in the home country, which will help KRBL to reduce the competition from the unorganized producers and companies having low-quality products.

Backward integration

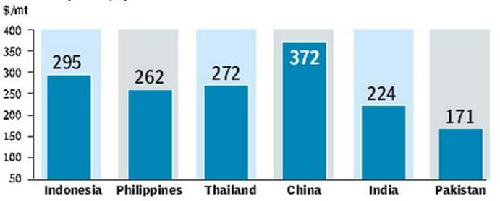

Backward integration done by KRBL in rice procurement, processing, warehousing, packaging and marketing will help the company to reduce the expenses and maintain higher margin on the various products. Export price per Metric Ton commands a premium of more than 18% over the Industry average is mainly due to backward integration.

Market leader and wide reach

“India Gate”, the flagship brand of Company, is the topmost selling rice in the branded rice segment, both in India and Overseas market Brand include – India Gate, Taj Mahal, Doon, Nur Jahan and many more. It has 25% share in the branded basmati rice sale in exports Market and more than 30% share in the Branded Basmati Rice sale in domestic market. KRBL has a strong distribution network with presence across 28 states domestically with over 480 nationwide distributors, who in turn have access to over four lakh retailers. Further, it exports basmati rice to over 27 countries across regions like Middle East, Iran, Europe, US and West Asia. The company has strong collaborations with large retail chains like Reliance Fresh, D Mart, Big Bazaar, Spencer’s, Aditya Birla-More, Hypercity in the domestic market and Carrefour, Fiesta, 4 Square, Giant, Shop Rite, New World, Lulu, Woolworths etc in the international market. This will help the company in order to grow faster than its competitors.

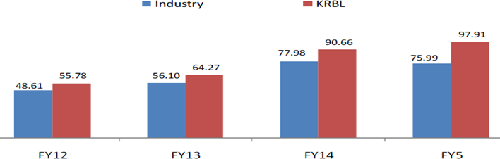

Growth prospects of the industry

Domestic market for basmati is growing at CAGR of ~13% and international market at a CAGR ~12%, KRBL being among the top most players in basmati market will be in a position to capitalize the growth and increase in demand of the basmati industry with its already existing manufacturing facilities and wide reach over different markets.

Sound financials

KRBL is having a sound financials, in the last three years Net Sales growth at CAGR of 24.66%, EBITDA growth at CAGR of 30.87%, Return on Capital Employed of 18.08% and average Return on Equity of 24.14%. With its business model allows the company to make quick cash flow and with no expansion plans in pine line Company is expected to maintain healthy financial position.

Industry Profile

With the probability of deficient monsoons does not cast a negative spell on Indian summer crops (or assuming that Skymet’s forecast is proved right) and rice production stays around 103 million tonnes (MT), India can again maintain top rank in world rice trade by shipping out about 12 MT in 2015-16. An adverse export performance by India can rattle worldwide rice trade with extreme volatility and exorbitant prices.

India has been top exporter in global rice trade of about 42 MT by averaging 10.5-11 MT (25% of world trade) annually during the last four years (since 2011). The sustainability in rice exports—the only one with a competitive-edge internationally as compared to other Indian agro commodities—is the resultant outcome of a combination of external factors, dynamics of domestic market, hybridisation of paddy, and efficient execution of contracted business both form east and west coast ports of India. Thailand has been trailing India by a small margin in the last two years, while India is also exposed to competition from Vietnam, Pakistan, Myanmar and Cambodia.

India primarily caters to the Middle East and Africa for non-Basmati and the EU and the US for Basmati variety. Dubai has emerged as a key trading hub for financing and facilitating payments, especially for Africa. Indian exports are undertaken by medium-sized private companies from open market, without any export subsidy or government intervention. No MNCs or PSUs or mega corporates are engaged in this business. After prohibition on exports was revoked in 2011, FCI’s stockholdings remain untouched. There are no MEP (minimum export price) or registration requirements that enable ease of doing business. Other Middle Eastern nations—Saudi Arabia, Kuwait, Yemen, UAE—are also keen to procure more of Pusa 1121 rice.

India’s MSP of non-Basmati paddy is about $224/MT. All other origins, except Pakistani, are costlier than India. Further, levy procurement by state governments stands abolished in 2014-15 which has enhanced market availability. FCI is trying to auction 25% broken rice (raw/parboiled) at OMSS of R23/kg while in open market 5% brokens parboiled can be bargained at R20-21/kg. There are virtually no takers for FCI stocks. This evidences market comfort in the supply side. There are multiple varieties on offer like IR36, IR64, 1001, Swarna, Sona Masuri, Ponni samba Parmal and P4 and that gives options for transacting the deal at right prices. Indian grain is available throughout the year even from West Bengal, Bihar, Chhattisgarh, Odisha and Jharkhand in addition to other growing regions. Rice is not traded in any future exchange and thus there is nil scope for open speculation or price rigging.

India’s presence in global rice trade is a great stabilizing force. Exports support better price realization for paddy farmers; Basmati is a product of specific GI (geographical identification) and is highly remunerative. India’s absence/decline from non-Basmati rice in international trade will spike prices more than $1000/MT fob (currently $350-400/MT) especially when Chinese appetite for rice is expanding. Thai jasmine (aromatic) rice may touch $3,000/MT fob (now at $850-$900) if our Basmati exports drop significantly. Hopefully that state of affairs will not arise despite poor monsoon due to more than sufficient carry-in inventory available with the government and in Indian markets. Source: Financial Express

Cost of production paddy production ($/mt)

Unit export price realization (Rs./Kg)

Peer group comparison

|

Sl. No. |

Name |

CMP (Rs.) |

P/E |

MC (Rs. Cr.) |

DY (%) |

CMP/BV |

|

1 |

540.05 |

51.99 |

4987.36 |

0 |

6.27 |

|

|

2 |

190.25 |

6.94 |

503.21 |

0.98 |

1.09 |

|

|

3 |

41.85 |

2.41 |

159.28 |

0 |

0.37 |

|

|

4 |

Lakshmi Energy & Foods Ltd |

9.35 |

-0.19 |

62.18 |

0 |

0.16 |

|

7 |

Kohinoor Foods Ltd |

46.05 |

162.28 |

159.29 |

-85.15 |

0.39 |

Risks and Concerns

Competition from unorganized sector

There are large number unorganized players in basmati manufacturing and selling industry delivering products at different standards. KRBL being the market leader is exposed to high completion from these players both in domestic and international markets.

Seasonal and climatic uncertainties

Rice being the primary raw material for its products KRBL is exposed changes in productivity of the rice due to seasonal and climatic changes and productivity of the crop.

Forex fluctuations

As ~45% of the company’s total revenue comes from export to different counties, KRBL is exposed to changes in the currency exchange rates. As it can make huge impact on the company’s overall revenue and margins.

Financials

Yearly financial review

-

The Company achieved highest ever Top Line of Rs. 3,159 Crores for the year ended March 2015 as compared to Rs 2,910Crores same period last year. An increase of ~9% over the same period last Year.

-

EBIDTA margin of Rs.527.68 Crores as compared to Rs. 460.11 Crores same period last year. An increase of ~15%.

-

Profit after Tax (PAT) at Rs. 322 Crores as compared to Rs. 255 Crores same period last year. An increase by 26%.

-

EPS for the period ended March 2015 at Rs. 13.64 per share as compared to Rs.10.82 per share same period last year.

-

Book value as 31‐3‐2015 stands at Rs. 56.28 per share vs. Rs 44.31 per share last year.

Q1FY16

|

Particulars (in Rs. Crs.) |

1st Qtr 201506 |

1st Qtr 201406 |

VAR [%] |

1st Qtr 201506 |

4th Qtr 201503 |

VAR [%] |

|

Gross Sales |

1006.32 |

805.46 |

24.90 |

1006.32 |

843.17 |

19.30 |

|

Excise Duty |

0 |

0 |

0 |

0 |

0 |

0.00 |

|

Net Sales |

1006.32 |

805.46 |

24.90 |

1006.32 |

843.17 |

19.30 |

|

Other Operating Income |

0 |

0 |

0 |

0 |

0 |

0.00 |

|

Other Income |

42.12 |

2.29 |

1739.30 |

42.12 |

7.01 |

500.90 |

|

Total Income |

1048.44 |

807.75 |

29.80 |

1048.44 |

850.18 |

23.30 |

|

Total Expenditure |

870.16 |

673.93 |

29.10 |

870.16 |

757.5 |

14.90 |

|

PBIDT |

178.28 |

133.82 |

33.20 |

178.28 |

92.68 |

92.40 |

|

Interest |

17.70 |

29.10 |

-39.20 |

17.70 |

20.24 |

-12.50 |

|

PBDT |

160.58 |

104.72 |

53.3 |

160.58 |

72.44 |

121.70 |

|

Depreciation |

11.63 |

16.25 |

-28.4 |

11.63 |

11.29 |

3.00 |

|

PBT |

148.95 |

88.47 |

68.4 |

148.95 |

61.15 |

143.60 |

|

Tax |

31.79 |

18.54 |

71.5 |

31.79 |

13.43 |

136.70 |

|

Fringe Benefit Tax |

0 |

0 |

0 |

0 |

0 |

0.00 |

|

Deferred Tax |

-2.43 |

-2.36 |

-3.00 |

-2.43 |

2.52 |

-196.40 |

|

Reported Profit After Tax |

119.59 |

72.29 |

65.4 |

119.59 |

45.20 |

164.60 |

|

Extra-ordinary Items |

-6.00 |

-1.56 |

-284.6 |

-6.00 |

4.62 |

-229.90 |

|

Adjusted Profit After Extra-ordinary item |

125.59 |

73.85 |

70.10 |

125.59 |

40.58 |

209.50 |

|

|

|

|

|

|

|

|

|

PBIDTM(%) |

17.7 |

16.7 |

6.7 |

17.7 |

11.0 |

61.2 |

|

PBDTM(%) |

16.0 |

13 |

22.8 |

16.0 |

8.6 |

85.8 |

|

PATM(%) |

11.9 |

9.0 |

32.4 |

11.9 |

5.4 |

121.6 |

Profit and Loss Account as per rough estimates

|

Particulars (in Rs. Crs.) |

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

Gross Sales |

2080.39 |

2910.46 |

3159.69 |

3986.57 |

4525.65 |

|

Excise Duty |

0 |

0 |

0 |

0 |

0 |

|

Net Sales |

2080.39 |

2910.46 |

3159.69 |

3986.57 |

4525.65 |

|

Other Operating Income |

0 |

0 |

0 |

0 |

0 |

|

Other Income |

18.89 |

19.56 |

43.62 |

59.16 |

71.53 |

|

Total Income |

2099.28 |

2930.02 |

3203.31 |

4045.16 |

4597.18 |

|

Total Expenditure |

1786.99 |

2469.91 |

2675.63 |

3375.31 |

3833.64 |

|

PBIDT |

312.29 |

460.11 |

527.68 |

669.85 |

763.53 |

|

Interest |

77.52 |

76.02 |

80.89 |

80.89 |

80.89 |

|

PBDT |

234.77 |

384.09 |

446.79 |

588.96 |

682.64 |

|

Depreciation |

50.57 |

57.66 |

52.69 |

62.26 |

64.82 |

|

PBT |

184.2 |

326.43 |

394.1 |

526.70 |

617.82 |

|

Tax |

54.59 |

71.41 |

74.65 |

105.34 |

120.48 |

|

Deferred Tax |

-0.25 |

-0.09 |

-2.28 |

-2.90 |

-3.92 |

|

Reported Profit After Tax |

129.86 |

255.11 |

321.73 |

354.84 |

434.24 |

|

Net Profit after Minority Interest & P/L Asso.Co. |

129.86 |

255.11 |

321.73 |

354.84 |

434.24 |

|

Extra-ordinary Items |

5.74 |

3.92 |

-3.40 |

-2.18 |

-3.23 |

|

Adjusted Profit After Extra-ordinary item |

124.12 |

251.19 |

325.13 |

357.02 |

437.47 |

|

|

|

|

|

|

|

|

PBIDTM(%) |

15.01 |

15.81 |

16.7 |

16.8 |

16.9 |

|

PBDTM(%) |

11.3 |

13.2 |

14.14 |

14.8 |

15.1 |

|

PATM(%) |

6.2 |

8.8 |

10.18 |

8.9 |

9.6 |

Balance Sheet as per rough estimates

|

Particulars (in Rs. Crs.) |

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

SOURCES OF FUNDS: |

|

|

|

|

|

|

Share Capital |

24.24 |

23.58 |

23.54 |

23.54 |

23.54 |

|

Reserves & Surplus |

805.23 |

1020.40 |

1301.23 |

1540.78 |

1848.25 |

|

Minority Interest |

0.88 |

0.88 |

0.88 |

0.88 |

0.88 |

|

Loan Funds |

835.57 |

1319.49 |

1281.46 |

1281.46 |

1281.46 |

|

Deferred Tax Liability |

15.96 |

15.87 |

12.67 |

14.39 |

12.94 |

|

Other Liabilities |

1.17 |

1.49 |

2.48 |

2.586 |

3.12 |

|

Total Liabilities |

1683.05 |

2381.71 |

2622.26 |

2863.63 |

3170.18 |

|

APPLICATION OF FUNDS: |

|

|

|

|

|

|

Fixed Assets |

457.61 |

576.86 |

753.15 |

777.70 |

802.26 |

|

Intangible Assets |

0.16 |

0.16 |

0.16 |

0.16 |

0.16 |

|

Investments |

6.27 |

6.30 |

6.60 |

5.511 |

5.60 |

|

Current Assets, Loans & Advances |

1515.86 |

2085.29 |

2280.38 |

2438.69 |

2738.10 |

|

Inventories |

1260.29 |

1690.02 |

1859.67 |

1977.63 |

2228.83 |

|

Sundry Debtors |

194.72 |

287.26 |

339.98 |

372.44 |

414.26 |

|

Cash & Bank Balance |

13.24 |

66.19 |

24.34 |

51.51 |

58.71 |

|

Other Current Assets |

4.25 |

7.27 |

7.58 |

7.89 |

8.2 |

|

Loans & Advances |

43.36 |

34.55 |

48.81 |

27.14 |

25.85 |

|

Current Liabilities & Provisions |

326.96 |

333.01 |

443.8 |

397.45 |

414.55 |

|

Net Current Assets |

1188.9 |

1752.28 |

1836.58 |

2041.24 |

2323.55 |

|

Other Assets |

30.11 |

46.11 |

25.77 |

39.17 |

38.78 |

|

Total Assets |

1683.05 |

2381.71 |

2622.26 |

2863.63 |

3170.18 |

Technical View

-

On monthly charts, the stock has given a breakout above Rs.162 levels and is currently trading at Rs.186.

-

Going forward, for the medium term, we feel the stock to get support around Rs.175 and Rs.172 levels, which can be used for averaging the stock.

-

It is currently trading above its 30, 50,100 and 200 Day EMAs and has been holding the same level for some weeks. This is a bullish signal.

-

Weekly traded volumes have shown a strong jump over the last couple of months, which is also a good sign.

-

Momentum oscillator RSI is pointing upwards and is at ~65 which means there is further upside possible.

Conclusion and Recommendation

We are positive on KRBL over the long term and hence recommend a BUY at CMP of RS.186.00 and further add on declines between Rs.172 to Rs.175 for a target of Rs.208 to Rs.223 with stop loss maintained at Rs.162.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.