Kotak Mahindra Bank Limited Research Report

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Bank |

1,829 |

Buy |

2,305 |

1-Year |

Kotak Mahindra Bank Limited - Q1 FY 2023 Review

Kotak Mahindra Bank Limited reported net revenue of ₹9,164.28 crores for the quarter ended June 30, 2022, compared to ₹8,042.82 crores for June 30, 2021. Profit After Tax was ₹2,755.39 crores for the quarter ended June 30, 2022, compared to ₹1,806.09 crores during the corresponding quarter of the previous year, respectively.

Kotak Mahindra Bank Limited - Investment Summary

|

CMP (₹) |

1,829 |

|

52 Week H/L |

1,631/2,253 |

|

Market Cap (crores) |

3,63,173 |

|

Face Value (₹) |

5.00 |

|

Promoter Holding (%) |

25.97 |

|

Non-Promoter Holding (%) |

74.03 |

|

Total (%) |

100.00 |

|

Book Value |

₹487 |

|

EPS TTM |

₹60.73 |

Kotak Mahindra Bank Limited - Overview

-

The Kotak group's flagship company, Kotak Mahindra Bank Limited, has varied operations that include financing for commercial vehicles, consumer loans, corporate finance, and asset rehabilitation.

-

The existing debt instruments of Kotak Mahindra Bank Limited have their CRISIL AAA/CRISIL AA+/FAAA/Stable/CRISIL A1+ ratings maintained by CRISIL Ratings.

-

The Bank has 1,702 branches and 2,761 ATMs.

Beta: 0.96 |

Alpha: 5.89 |

Risk Reward Ratio: 1.45 |

Margin of Safety: 21% |

Kotak Mahindra Bank Limited - Quarterly Summary

|

Quarterly (INR in crores) |

Jun-22 |

Mar-22 |

Dec-21 |

Sep-21 |

Jun-21 |

|

Interest Income |

9,164 |

8,838 |

8,626 |

8,233 |

8,043 |

|

Interest Expended |

3004.23 |

2903.41 |

2918.94 |

2880.22 |

2850.72 |

|

Net Interest Income |

6,160 |

5,935 |

5,707 |

5,353 |

5,192 |

|

|

|

|

|

|

|

|

Other Income |

2494.66 |

7960.08 |

5549.8 |

7108.56 |

4528.79 |

|

Total Income |

8,655 |

13,895 |

11,257 |

12,461 |

9,721 |

|

|

|

|

|

|

|

|

Employee Cost |

1839.09 |

1857.34 |

1837.2 |

1853.02 |

1593.37 |

|

Policy Holders' Reserves, Surrender Expense and Claims |

584.46 |

4899.38 |

2828.06 |

4257.75 |

3062.4 |

|

Other Expenses |

2536.46 |

2449.03 |

2299.37 |

1985.6 |

1687.06 |

|

Provision and Contingencies |

8.8 |

-398.6 |

-118.13 |

434.18 |

858.67 |

|

EBT |

3,685.90 |

5,087.65 |

4,410.72 |

3,930.88 |

2,519.39 |

|

|

|

|

|

|

|

|

Tax Expenses |

973.51 |

1228.56 |

1073.1 |

990.17 |

724.6 |

|

PAT before Minority Interest & Share in Profit/(Loss) of Associates |

2,712.39 |

3,859.09 |

3,337.62 |

2,940.71 |

1,794.79 |

|

|

|

|

|

|

|

|

Minority Interest |

- |

- |

- |

- |

- |

|

Share in Profit/(Loss) of Associates |

43 |

33.07 |

65.12 |

48.03 |

11.3 |

|

Net Profit |

2,755.39 |

3,892.16 |

3,402.74 |

2,988.74 |

1,806.09 |

Business

-

Kotak Capital Management Finance Ltd., the predecessor to Kotak Mahindra Bank Ltd., was formed in 1985. The company was renamed Kotak Mahindra Finance Ltd. on April 8, 1986.

-

They began their auto finance division in 1990 and their investment banking division the following year. They also acquired FICOM, one of India's biggest financial retail marketing networks.

-

The Reserve Bank of India granted the company a license to conduct banking operations in February 2003. (RBI). Since Kotak Mahindra Finance Ltd. is the first non-banking finance firm in India to transform into a bank as Kotak Mahindra Bank Ltd., this permission established banking history. They started conducting banking business in March 2003.

-

On July 20, 2014, Kotak Mahindra Bank Ltd announced that it had signed a Share Purchase Agreement (SPA) to pay Rs 459 crore to Financial Technologies (India) Ltd (FTIL) for a 15% equity holding in Multi Commodity Exchange of India Ltd (MCX).

-

The merging procedure between ING Vysya Bank and KMBL was finished as of April 1, 2015.

-

The Reserve Bank of India has permitted Kotak Mahindra Bank to open its first overseas office in Dubai International Financial Centre (DIFC) Dubai, the bank stated on November 11th, 2016.

-

On March 29, 2017, Kotak Mahindra Bank announced the introduction of 811', a cutting-edge full-service mobile ecosystem for digital banking that is exclusive to India and will power the bank's organic development strategy.

-

The first zero-contact video KYC savings account in India is introduced by Kotak 811 during FY2020.

-

The business segment of Kotak Mahindra Bank is as follows:

-

Consumer Banking:

-

The Consumer Bank division provides services to a broad range of clients, including domestic people and households, non-residents, small and medium-sized businesses, and Various business categories exist for a variety of goods, from simple Savings and Current Accounts through Term Deposits, Credit Cards, Unsecured and Secured Loans, Cash flow, electronic payments, and investments.

-

-

Commercial Banking:

-

In the sectors of commercial vehicles (CV), construction equipment (CE), tractors, and agriculture businesses, the commercial banking section offers financial solutions. It provides financing for tractors, crop loans to small businesses, and allied agricultural activities to serve the priority sector.

-

-

Corporate Banking:

-

The corporate banking segment serves numerous corporate customer sectors, including significant Indian corporates, conglomerates, financial institutions, public sector organizations, international corporations, new age companies, small and medium enterprises, and real estate firms.

-

-

Private Banking:

-

One of the oldest and most prestigious Indian private banking segments, private banking provides services to several illustrious Indian families. More than half of India's top 100 families' fortune is managed by firms (Source: Forbes India Rich List 2021), with a variety of clientele, including entrepreneurs and professional and business families.

-

-

International Banking Units:

-

The Bank has two International Banking Units ("IBUs") situated in IDFC in Dubai, United Arab Emirates, and GIFT City in Gandhinagar, Gujarat. The IBUs possess their separate treasuries to oversee regulatory requirements and liquidity buffers, such as the Liquidity Coverage Ratio (LCR), among other things and also provide other services.

-

Services provided by banks include term loan facilities for a range of needs, trade financing, foreign exchange management, etc.

-

-

Asset Reconstruction:

-

The Asset Reconstruction Division (ARD) of the Bank evaluates opportunities and assumes exposure in distressed/non-performing asset (NPA) accounts through the purchase of stressed or non-performing assets from other banks, the use of Security Receipts ("SR"), priority finance, and working capital assistance with a focus on finding a solution and changing them.

-

The bank invests in SRs offered by Asset Reconstruction Companies as a Qualified Institutional Buyer (QIB).

-

The bank has been actively involved in the distressed asset buyout and investment market for approximately 20 years.

-

-

Treasury:

-

The Treasury of the Bank actively participates by:

-

The Balance Sheet Management Unit ("BMU") guarantees that regulatory reserves and sufficient liquidity are maintained and Investment requirements. Following the bank's overall risk appetite, the BMU also controls interest rate and liquidity risk.

-

Trades in proprietary goods include those in fixed-income securities, money markets, derivatives, foreign exchange, and equity. The Proprietary Desk aids teams serving customer needs by facilitating interbank access.

-

The Treasury's customer service desks facilitate and oversee customer transactions in the areas of foreign exchange and derivatives and gold-related products. The Forex and Derivatives Desk makes it easier for clients to access foreign exchange markets by offering cash and derivatives products.

-

-

-

-

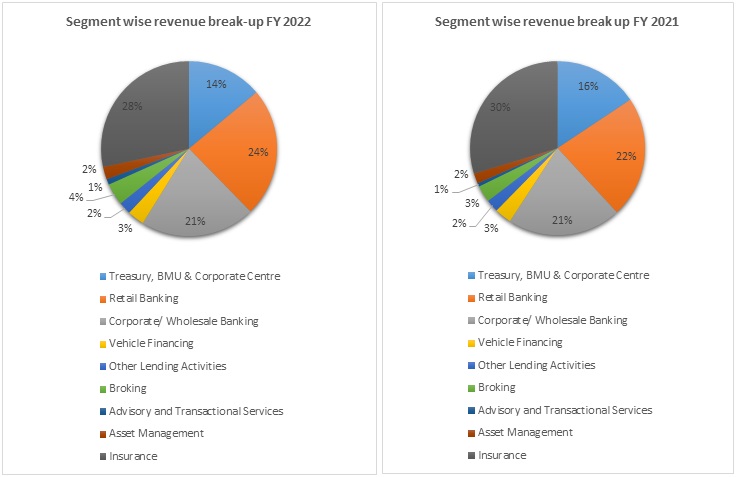

Out of the total revenue, 14% has been generated from Treasury, BMU & Corporate center, 24% from Retail Banking, 21% from Wholesale Banking, 3% from Vehicle Financing, 2% from Other Lending activities, 4% from Broking, 1% from Advisory and Transactional services, 2% from Asset Management, and 28% from Insurance in FY 2022 compared to 16%, 22%, 21%, 3%,2%, 3%, 1%, 2%, and 30% in FY 2021, respectively.

SWOT ANALYSIS

-

Strength:

-

Diversified business model.

-

Experienced management.

-

Customer service.

-

Strong customer base.

-

-

Weakness:

-

Poor marketing.

-

Promoter shareholding is low.

-

Interest rate risk.

-

-

Opportunities:

-

Increase in banking demand

-

Overseas expansion.

-

Presence in Asset Management.

-

Branches are well catered in different parts of India.

-

-

Threats:

-

Increasing competition in the financial sector.

-

Ongoing uneven circumstances globally (e.g., Inflation).

-

Kotak Mahindra Bank Limited - Revenue Trend

Kotak Mahindra Bank Limited - Ratio Analysis

|

|

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Interest Income |

4.24% |

4.59% |

4.47% |

4.69% |

|

Gross NPA |

1.94% |

2.16% |

3.22% |

2.37% |

|

Net NPA |

0.70% |

0.70% |

1.23% |

0.71% |

|

Provision Coverage Ratio |

71.9% |

76.3% |

70.23% |

79.05% |

|

Capital Adequacy Ratio |

17.45% |

19.21% |

23.38% |

23.68% |

|

CASA Ratio |

52.5% |

56.2% |

60.68% |

60.68% |

|

ROA |

1.99% |

2.10% |

2.16% |

2.26% |

|

ROE |

13.28% |

13.75% |

12.80% |

13.42% |

|

Cost to Income Ratio |

62.26% |

59.44% |

63.12% |

64.8% |

Kotak Mahindra Bank Limited - Financial Overview

Kotak Mahindra Bank Limited - Profit and Loss Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Interest income |

25,131.08 |

29,831.22 |

33,474.16 |

32,819.83 |

33,740.40 |

|

Interest Expended |

12,466.85 |

15,186.61 |

15,900.68 |

12,966.55 |

11,553.29 |

|

Net Income |

12,664.23 |

14,644.62 |

17,573.48 |

19,853.28 |

22,187.10 |

|

|

|

|

|

|

|

|

Other income |

13,682.23 |

16,147.89 |

16,891.58 |

23,587.68 |

25,310.61 |

|

Total income |

26,346.46 |

30,792.51 |

34,465.06 |

43,440.96 |

47,497.71 |

|

|

|

|

|

|

|

|

Other expenses |

16,163.49 |

19,171.42 |

20,485.15 |

27,420.19 |

30,777.77 |

|

Provision and Contingencies |

4,035.83 |

4,501.39 |

5,372.82 |

6,117.87 |

4,788.07 |

|

|

|

|

|

|

|

|

PAT before Share in Profit/(Loss) of Associates & Minority Interest |

6,147.14 |

7,119.70 |

8,607.08 |

9,902.90 |

11,931.87 |

|

|

|

|

|

|

|

|

Share of Minority Interest |

(56.67) |

- |

- |

- |

- |

|

Share in Profit/(Loss) of Associates |

110.51 |

84.43 |

-13.72 |

87.31 |

157.52 |

|

|

|

|

|

|

|

|

Net Profit |

6,200.97 |

7,204.13 |

8,593.36 |

9,990.20 |

12,089.39 |

|

|

|

|

|

|

|

|

Preference Dividends, including Tax |

32.66 |

32.37 |

48.82 |

40.50 |

40.50 |

|

Net Profit |

6,168.31 |

7,171.76 |

8,544.54 |

9,949.70 |

12,048.89 |

|

|

|

|

|

|

|

|

EPS |

|

|

|

|

|

|

Basic |

32.53 |

37.61 |

44.73 |

50.53 |

60.76 |

|

Diluted |

32.49 |

37.57 |

44.68 |

50.49 |

60.73 |

|

|

|

|

|

|

|

|

Number of shares |

|

|

|

|

|

|

Basic |

189.60 |

190.68 |

191.02 |

196.90 |

198.31 |

|

Diluted |

189.86 |

190.91 |

191.23 |

197.04 |

198.40 |

Kotak Mahindra Bank Limited - Cash Flow Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Profit Before Tax |

9158.224 |

10575.72 |

11421.801 |

13168.337 |

15948.301 |

|

Net Cash from Operating Activities |

(10392.4) |

1822.383 |

46618.8289 |

4881.1312 |

8417.9934 |

|

Net Cash Used for Investing Activities |

(5,608.25) |

(3,376.56) |

(13,198.87) |

(11,116.14) |

(11,084.40) |

|

Net Cash From (Used For) Financing Activities |

14,679.40 |

(2,304.59) |

(1,267.45) |

(989.74) |

(4,753.37) |

|

Net Increase in Cash and Cash Equivalents |

(1,187.92) |

6,869.83 |

32,815.39 |

(16,363.23) |

4,948.86 |

|

Cash And Cash Equivalents at The Beginning of the Year |

25588.55 |

24400.63 |

31270.4613 |

64085.848 |

47722.62 |

|

Cash And Cash Equivalents at The End of the Year |

24,400.63 |

31,270.46 |

64,085.85 |

47,722.62 |

52,671.48 |

Kotak Mahindra Bank Limited - Balance Sheet (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

CAPITAL AND LIABILITIES: |

|

|

|

|

|

|

Capital |

952.8243 |

1454.3774 |

1456.5192 |

1490.9178 |

1492.3309 |

|

Employees Stock Options Outstanding |

2.168 |

2.0728 |

2.8654 |

2.1588 |

31.3063 |

|

Reserves and Surplus |

49533.2422 |

56825.3545 |

65677.6002 |

83345.5267 |

95641.6988 |

|

Deposits |

1,91,235.80 |

2,24,824.26 |

2,60,400.21 |

2,78,871.41 |

3,10,086.89 |

|

Borrowings |

58,603.97 |

66,438.94 |

65,576.72 |

47,738.90 |

55,148.27 |

|

Policyholders' Funds |

22,425.34 |

27,417.81 |

31,508.82 |

42,071.52 |

50,666.79 |

|

Other Liabilities and Provisions |

14967.1302 |

18208.4325 |

18549.9855 |

25333.7867 |

33430.6239 |

|

Total |

3,37,720.47 |

3,95,171.25 |

4,43,172.71 |

4,78,854.22 |

5,46,497.91 |

|

|

|

|

|

|

|

|

ASSETS: |

|

|

|

|

|

|

Cash and Balances with Reserve Bank of India |

8933.5019 |

10910.9235 |

9513.2346 |

12528.0021 |

16049.1782 |

|

Balances with Banks and Money at Call and Short Notice |

15,467.13 |

20,353.54 |

54,566.61 |

35,188.62 |

36,616.31 |

|

Investments |

90,976.60 |

1,03,487.02 |

1,11,196.91 |

1,56,945.55 |

1,64,529.41 |

|

Advances |

2,05,997.32 |

2,43,461.99 |

2,49,878.96 |

2,52,169.75 |

3,04,473.60 |

|

Fixed Assets |

1749.829 |

1883.709 |

1860.9626 |

1740.1626 |

1909.6314 |

|

Other Assets |

13803.0254 |

14260.3103 |

15342.277 |

19468.3795 |

22106.0369 |

|

Goodwill on Consolidation |

793.0606 |

813.753 |

813.753 |

813.753 |

813.753 |

|

Total |

3,37,720.47 |

3,95,171.25 |

4,43,172.71 |

4,78,854.22 |

5,46,497.91 |

Industry Overview

-

The NPA ratio for public sector banks decreased from 9.4% in June 2021 to 7.2% in June 2022, while it decreased from 4.2% to 3.1% in the same month for private banks.

-

Early in June 2022, yearly growth in bank lending by scheduled commercial banks (SCBs) reached 13.1% as the Indian economy struggled to recover from pandemic waves. The catalyst has been wholesale credit, which changed its decreasing trend from a year ago to one of double-digit growth. At the same time, retail credit growth remained healthy.

-

In the banking industry, private sector banks continue to outperform their counterparts in the public sector in terms of loan growth, both wholesale and retail.

-

Asset quality in the banking sector has increased during the past year, helped by an uptick in economic activity. Even if concerns about restructured credit persist, bad loans decreased by around 185 basis points to 5.7% of all loans.

-

Non-performing assets (NPAs) are on a relatively low level on banks' balance sheets drop for both wholesale and retail loans and enough capital buffers. In a dynamic climate marked by significant uncertainty, the drop in risk-weighted assets shows that banks are still cautious about the risk profile of borrowers.

-

The Morgan Stanley study stated that "strong balance sheets, waning economic concerns, and better capacity utilization lay the scenario for a Capex up-cycle in FY24-FY25, which might fuel a second leg of rerating at Indian banks."

-

S&P Global Ratings projected that bad loans in India’s banking sector will decline to 5%-5.5% of gross loans by 31 March 2024. Credit costs are predicted to settle around 1.5% for FY23 and then normalize further to 1.3%, bringing them comparable to those of other emerging economies and the 15-year average for India.

-

According to rating agency ICRA, bank bad loan ratios are anticipated to further decrease to 5.2–5.3% by 31 March 2023 due to a lower slippage rate and stronger credit growth.

Concall Overview (Q1FY2023)

-

Unsecured retail's share of the bank’s standalone advances was 5.6% in June of 21; as of Q1FY2023, it is already around 7.5%. As they increase this book over the next few quarters from its present 7% odd, management is considering resolving this as they do so. In the current loan portfolio's mix, management would thus continue to see unsecured retail loans expand.

-

The management anticipates that non-employee costs will rise even more over the next two to three quarters as a result of rising advertising, promotion, technology & communication costs.

-

Approximately 69% of all loans and advances are floating rates, with EBLR (repo linked) being 50%. In less than a year, the fixed plus floating rate book is around 80% of advancements.

-

With an emphasis on semi-urban and rural areas, the bank continues to expand its retail MFI book. Personal loan growth was driven by strong demand and 40% of Digitally and internally, we source retail loans.

-

Growth in retail term deposits primarily results from the increase in interest rates and the tendency is anticipated to remain for the ensuing quarters.

-

The credit card segment currently has grown at the rate of 30%, which is in line with the industry.

-

In Q1FY23, Kotak Prime took a hit of ₹ 111 crores pre-tax on account of a change in accounting policy which is related to brokerage costs.

-

The commercial vehicle finance business had a strong expansion during the quarter on a YoY basis, the trend for payments improved. A need for financing was fueled by the need for replacement vehicles, and PV utilisation has increased across all market sectors. Bank keeps expanding and gaining market share in the financing of commercial vehicles.

Kotak Mahindra Bank Limited - Technical Analysis

-

Stock is trading below EMA 200 and MA 200 indicators, with a support level of ₹1726 and a resistance level of ₹2042.

-

One can accumulate this stock at current levels.

Peers Comparison

|

|

FY-2022 |

|||

|

|

GNPA |

NPA |

ROA |

ROE |

|

HDFC Bank Limited |

1% |

0.32% |

1.79% |

15.38% |

|

ICICI Bank Limited |

4% |

0.76% |

1.43% |

14.04% |

|

Kotak Mahindra Bank Limited |

2% |

0.71% |

2.21% |

12.50% |

Recommendation Rationale

-

While a capital raising of Rs. 7,442.5 crores further reinforced the capital cushions in FY2021, Kotak Mahindra Bank Limited’s (KMBL's) capital adequacy ratio remained high, with the Tier I at 21.7% and CRAR at 22.7% as of March 31, 2022 (versus 21.4% and 22.3%, respectively, as of March 31, 2021).

-

Consolidated capitalization for KMBL is still robust, with a Tier I ratio of 22.8% (up from 22.6% as of March 31, 2021). In terms of capital requirements, the subsidiaries are self-sufficient, and any capital support given to them is anticipated to stay manageable in light of the bank's overall profits and capital.

-

The growth of KMBL's savings account (SA) deposits slowed to 6% in FY2022 (from 12% in FY2021 and 31% in FY2020) to ₹1.24 lakh crore, but the current account (CA) deposits' strong growth of 24% to ₹. 0.65 lakh crore and the overall CASA's growth of 12% YoY to ₹1.89 lakh crore as of March 31, 2022, offset this decline.

-

Additionally, KMBL continues to offer term deposits at an interest rate that is greater than that of peer banks, which has contributed to the term deposit market's growth of almost 11% in FY2022. At 60.7% as of March 31, 2022 (down from 60.4% as of March 31, 2021), CASA deposits still make up a sizable portion of all deposits, ranking among the largest in the sector.

-

The cost of interest-bearing funds decreased, which helped to maintain the gradual widening of lending spreads and improved the net interest margin (NIM), which rose to 4.14% of average total assets (ATA) in FY2022 from 4.1% in FY FY2021. The Covid-19 epidemic significantly slowed down total net advances growth in FY2021-H1 FY2022, while the bank's NIMs continued to rise.

-

The fresh NPA generation climbed to 2.52% in FY2021 once the pandemic started, before it started to decline to 1.80% in FY2022. The rate of NPA creation is going towards the pre-Covid-19 level of 1.2-1.7% throughout FY2017-FY2020 as the influence of Covid-19 gradually fades.

-

With gross non-performing advances (GNPAs) and net NPAs (NNPAs) at 2.34% and 0.64%, respectively, as of March 31, 2022, the headline asset quality measures remain good.

-

Significantly high recoveries and upgrades, which helped mitigate the effects of relatively greater slippages, were another factor supporting the overall increase in the asset quality indicators.

-

During the pandemic, KMBL restricted its unsecured loans. The share of the unsecured retail book, which primarily consists of personal loans, microloans, and credit cards, increased slightly to 6.8% as of March 31, 2022, from 5.8% as of March 31, 2021, even though it still remains low in comparison to net advances, as a result of the increased confidence in lending to customers in this segment.

-

The difference in the cost of funding between KMBL and peer banks has decreased as a result of the rate cuts, which were mostly implemented in FY2021. However, retaining the cost advantage will depend on KMBL's capacity to do so in an environment with tighter liquidity.

-

In the future, worsening macroeconomic factors, including rising inflation that raises interest rates and currency depreciation, could be difficult for borrowers and problematic for banks' asset quality.

-

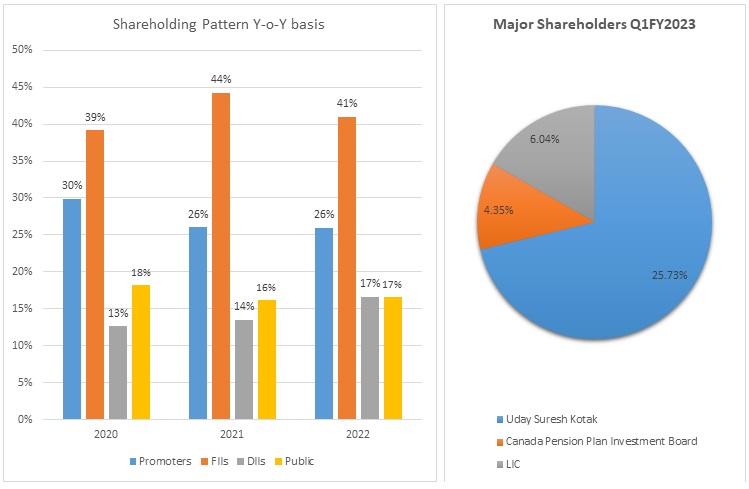

Promoter has reduced their shareholding by 29.92% in FY 2020 to 25.97% in Q1FY2023.

Valuation

-

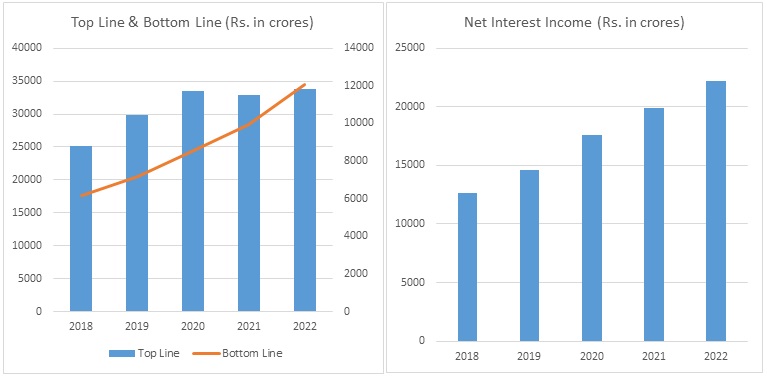

The Bank’s Net Interest Income has increased at a CAGR of 8% from FY 2018-2022.

-

The Bank’s Net Profit has increased at a CAGR of 13% from FY 2018-2022.

-

In comparison to FY 2020–21, the bank’s return on average net worth increased to 13.42% in FY 2021–22. In times of uncertainty, the Bank maintained a high capital adequacy ratio, which harmed return on equity.

-

In FY 2022, the contribution of other income to the bank's total revenue was approximately 43%, and the contribution of insurance premiums to other income was approximately 53%.

-

We anticipate the company could generate higher Net Interest income for the following FY 2023, comparable to the prior year, based on the company's present performance in FY 2022.

-

We used data from the last five years (2018-2022) to anticipate revenue for the fiscal years 2023–2027.

Kotak Mahindra Bank Limited - Estimated Income Statement (₹ in crores)

|

|

Mar-23 |

Mar-24 |

Mar-25 |

Mar-26 |

Mar-27 |

|

|

2023-E |

2024-E |

2025-E |

2026-E |

2027-E |

|

Interest income |

36,319 |

39,095 |

42,083 |

45,299 |

48,761 |

|

Interest Expended |

12,246 |

12,981 |

13,760 |

14,586 |

15,461 |

|

Net Interest Income |

22,187 |

24,073 |

26,114 |

28,323 |

30,713 |

|

|

|

|

|

|

|

|

Other income |

27,159 |

29,143 |

31,272 |

33,556 |

36,007 |

|

Total income |

51,232 |

55,257 |

59,595 |

64,269 |

69,307 |

|

|

|

|

|

|

|

|

Other expenses |

31,234 |

33,622 |

36,191 |

38,957 |

41,935 |

|

Provision and Contingencies |

5,085 |

5,473 |

5,892 |

6,342 |

6,827 |

|

PAT |

14,913 |

16,162 |

17,512 |

18,970 |

20,546 |

-

We initiate coverage on Kotak Mahindra Bank Limited with a “Buy” and a 1-year Target Price ₹2305.

Disclaimer: This report is only for the information of our customers Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.