HESTER BIOSCIENCE

Hester Biosciences Ltd is engaged in manufacturing & marketing animal vaccines & health products. Its products include vaccines, health products & diagnostics and services include seroprofiling for poultry flocks & the m3 expert program.

|

BSE |

524669 |

|

NSE |

HESTERBIO |

|

REUTERS |

HEST.BO |

|

INCEPTION |

1987 |

|

IPO |

1994 |

|

INDUSTRY |

PHARMA |

|

CMP (as on 22/1/2016) |

480 |

|

Stock Beta |

1.1476 |

|

52 Week H/L |

405 / 848.90 |

|

Market Cap (Cr) |

427 |

|

Equity Capital (cr) |

8.51 |

|

Face Value (Rs) |

10 |

|

Average Volume |

15263 |

|

Shareholding Pattern (%) |

|

|

Promoters |

44.62 |

|

Non Promoters |

55.38 |

|

Grand Total |

100 |

Hester Biosciences Ltd - Potential Catalysts

-

Animal Health Products to Piggy Back on Vaccines Sales and Expand Multi-fold in Few Years

-

PPR Eradication Program by FAO - A Tremendous Opportunity for Hester

-

Expansion - Nepal Manufacturing Facility

-

Hester’s Strength – Cold Storage and Distribution

-

Rising Meat, Milk and Egg Consumption to Boost Vaccines Sales

Hester Biosciences Ltd - Recommendation

Hester Biosciences Ltd plans to expand the business of its health products to a large scale and expects that health products will contribute more sales rupees than will vaccines in years to come. In light of these opportunities, the big picture of HBL looks ‘exciting’.

With Superior project management skills, focus on measuring and monitoring quality and its planned expansion, we believe HBL will expand further. We recommend BUY on the stock at CMP of Rs. 480 to target of Rs. 957.

Hester Biosciences Ltd - Financial Summary

BUSINESS DISCRIPTION

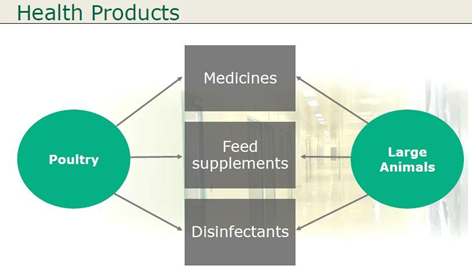

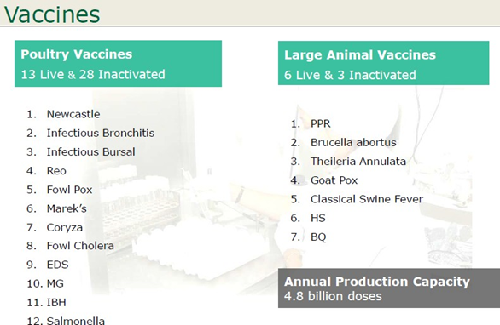

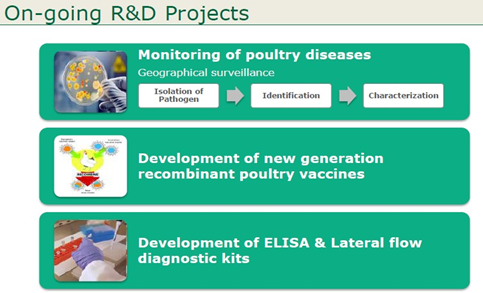

Hester Biosciences Limited is an India-based company engaged in manufacturing and marketing of poultry vaccines. The Company's product range includes vaccines, health products and diagnostics. The Company has four business divisions, which include poultry vaccine, poultry health products, large animal vaccines and large animal health products. The Company provides medicinal and health product needs of poultry, sheep, goats, cattle and pigs. The Company's portfolio includes vaccines, medicines, feed supplements and disinfectants. The Company's products include avian, which includes Live B1, Live LAS, Live R2B, Live M48, Live LAS-MAS, Gumboro M1, Gumboro I and Gumboro I+, among others; swine fever vaccine, and large animal live vaccine, which includes goat pox vaccine, PPR Vaccine-Sungri 96 strain, PPR Vaccine-Nigerian 75/1 strain and Brucella abortus (S19) calf Vaccine. It also offers seromonitoring services to poultry and dairy farmers to monitor the health status of their animals.

Having worked as India’s leading distributor for poultry health products and being passionate about animal health, Mr. Rajiv Gandhi, a first-generation entrepreneur founded Hester in 1987 and is currently CEO and MD of HBL. The company was listed in 1994 under the name Hester Pharmaceuticals Ltd. Hester began its humble journey when it rolled out the first Poultry Vaccine batch in 1997. In 2003, Hester terminated the collaboration agreement with the American company and since then Hester has been a 100% Indian company. Hester Biosciences Ltd (HBL) is exclusively into animal health (perhaps only listed firm in India doing business exclusively in animal health) and has no business/products in human health. HBL has two manufacturing units - Its first and largest manufacturing unit is located in Kadi, Mehsana district of Gujarat. The second is located in Kathmandu, Nepal is under construction. HBL is a WHO-GMP, ISO 9001:2008, ISO 14001:2004, OHSAS 18001:2007 & GLP certified company.

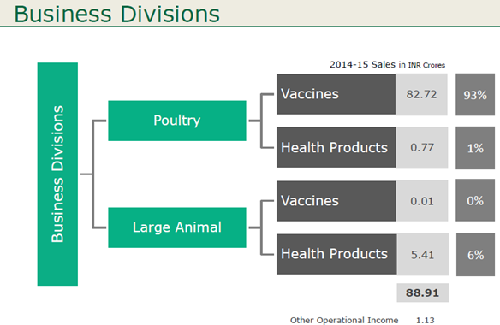

Hester’s Business Segments

Hester Biosciences Ltd (HBL) has four business segments: Poultry Vaccines, Poultry Health Products, Large Animal Vaccines, Large Animal Health Products. Currently, Hester manufactures and markets Livestock (animals reared for a commercial purpose) products only, and does not market products for pet care.

Poultry Vaccines Segment: Hester Biosciences Ltd (HBL) manufactures about 15 live and 23 inactivated vaccines for poultry at its plant in the Mehsana district of Gujrat. Many of these vaccines are intended to protect the chicken from Newcastle disease (also known as Ranikhet), Infectious Bursal disease (IBD) also known as Gumboro, Infectious Bronchitis, Fowl Cholera, Egg Drop Syndrome. Current capacity utilization is about 95% for inactivated vaccines and about 50% for live vaccines.

Hester Biosciences Ltd (HBL) plans to expand its inactivated vaccines capacity and has allocated about Rs.170 Mn to be spent in FY16E. The expansion will be funded with internal accruals and bank limits. While inactivated vaccines would mostly be sold in the Indian markets, Live vaccines would be majorly exported, mostly to African countries where the use of live vaccines is higher than Inactivated vaccines

Large Animal Vaccines Segment

Hester Biosciences Ltd (HBL) started manufacturing and marketing large animal vaccines in March 2015 and currently manufactures 4 live vaccines for large animals – 1. PPR vaccine (sheep and goat plague) one with Indian Sungri strain at Mehsana plant, the other with Nigerian strain, which would be manufactured at its Nepal plant likely starting Oct 2015. 2. Goat Pox vaccine, HBL is the first company to manufacture Goat Pox vaccine in India. 3. Brucella abortus (S19) calf Vaccine. During Q1’ FY16 sales of Large Animal, vaccines were about Rs. 0.3 Mn.

Poultry Health Products

Under this division, Hester Biosciences Ltd primarily sells feed additives and medicinal products for poultry. Sales during FY15 were Rs.7.7 Mn. Poultry health products are manufactured by a third party under toll manufacturing.

Large Animal Health Products constitute medicinal products (pharmaceuticals), feed additives, and disinfectants. In about 5 years' time, HBL estimates that this division will contribute the highest revenue among the four divisions. HBL does not manufacture large animal health products but gets the products toll manufactured under loan license manufacturing. Sales during FY15 were Rs.54.12 Mn.

MANAGEMENT & GOVERNANCE

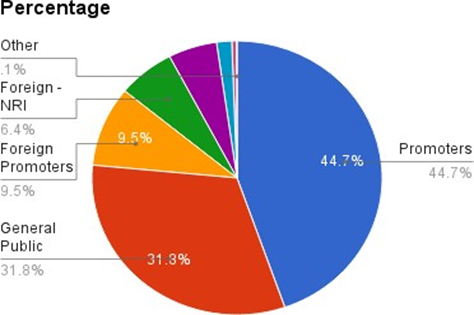

Shareholding pattern as on Sept 30th, 2015

|

Category |

No. of Shares |

Percentage |

|

Promoters |

3,795,417 |

44.62 |

|

General Public |

2,705,762 |

31.81 |

|

Foreign Promoters |

803,955 |

9.45 |

|

Foreign - NRI |

540,621 |

6.36 |

|

Other Companies |

461,256 |

5.42 |

|

NBFC and Mutual Funds |

144,028 |

1.69 |

|

Foreign Institutions |

42,404 |

0.5 |

|

Others |

5,857 |

0.07 |

The company’s management includes Ms.Amala Parikh, Dr.Bhupendra V Gandhi, Mr.Amit Shukla, Mr.Jigar Shah, Mr.Naman Patel, Mr.Rajiv Gandhi, Mr.Ravin Gandhi, Mr.Sanjiv Gandhi, Mr.Vishwesh Patel, Ms.Amala Parikh, Ms.Grishma Nanavaty.

Company has Shah Narielwala & Co. as its auditors. As on 30-Sep-2015, the company has a total of 8,506,800 shares outstanding.

INVESTMENT RATIONALE

Animal Health Products to Piggy Back on Vaccines Sales and Expand Multi-fold in Few Years

Hester Biosciences Ltd is planning to leverage its existing vaccines cold storage and marketing & distribution network to sell animal health products (medicines, feed additives and disinfectants). Health products are expected to become the top contributor to total revenue, which is the case with most large multinational animal health companies.

Animal health product sales during FY15 were a tiny 6% of total sales. Margins are expected to be little lower than those in vaccines but revenues would be much larger than vaccines. HBL will get these products toll-manufactured (loan license manufacturing) from third parties and market it under the Hester brand.

PPR Eradication Program by FAO - A Tremendous Opportunity for Hester

Food and Agriculture Organization (FAO) has embarked on a mission to eradicate PPR disease (plague affecting Sheep and Goats) and has planned to spend about US$ 7.6 Bn over a span of 15 years starting 2015. Annual spend on PPR vaccines will be about US$ 0.5 Bn in the initial stages. This is a tremendous opportunity and HBL (Hester Biosciences Ltd.) has already set up a plant in Nepal to manufacture and export PPR vaccines worldwide.

Hester Biosciences Ltd has already begun establishing cold storage and distribution networks, the backbone of vaccines business, across southern and eastern Africa. International manufacturers have priced the vaccine at 10 US cents per dose, but Hester would be aggressively pricing between 2.5 to 3.5 US cents.

Nepal Manufacturing Facility

Nigerian strain is used to manufacture PPR vaccine worldwide except in India, where Sungri strain is used. Manufacture and use of Nigerian strain PPR vaccine is banned in India because of the risks of accidentally introducing Nigerian strain in India, where it is not found. For this reason, Hester constructed a plant near Kathmandu, Nepal at a cost of about Rs.360 Mn to manufacture Nigerian strain PPR and other Animal vaccines. Anticipating the global demand of PPR on account of PPR eradication, HBL has set up the plant in Nepal which can generate annual sales of Rs. 500 Mn operating at full capacity.

HBL’s management believes that it can easily scale up the capacity to even 3x depending upon the demand for PPR vaccines. Nepal plant is expected to start production in Oct 2015.

Hester’s Strength – Cold Storage and Distribution

The backbone of the vaccines business is cold storage and distribution because in order to keep vaccines potent and effective, vaccines should be stored at low temperatures between 2 C and 8 C. Most of the places in African countries have hot climates, are very remote and lack widespread refrigeration. Thus, storage points and transportation networks are critical for the success of the vaccines business.

Hester Biosciences Ltd has invested in a distribution network in Botswana and is also creating a depot in Nairobi, Kenya. HBL has appointed distribution in various countries mainly in the Southern part of Africa as well as Eastern Africa. HBL has registered a company by the name of Hester Biosciences Africa in Kenya. In order to create an efficient distribution network, HBL has plans to establish its own depots in one of the African countries, have its own sub-depots, which could be either completely Hester-owned or in a partnership with a local agency and have stock points in various countries. HBL is planning ahead to benefit from the PPR eradication opportunity

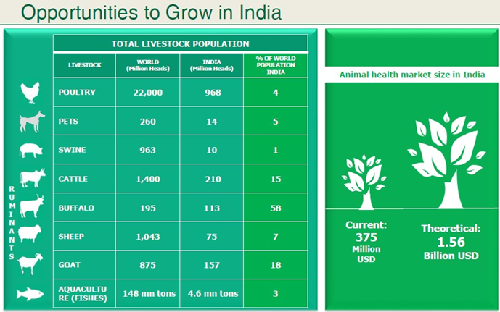

Rising Meat, Milk and Egg Consumption to Boost Vaccines Sales

The vast gap between India&rsquo's current per capita annual consumption (54 eggs and 3.5 kg. of meat) and the National Institute of Nutrition (NIN) recommended level (180 eggs and 11 kg of meat) offers a tremendous opportunity for the growth of poultry industry, at least for the next 20 years. As the disposable income rises steadily over the years coupled with urbanization in most parts of India, the growth in demand for poultry products is likely to sustain.

Domestic poultry meat production is estimated to have increased from less than 1.0 Million Tons (MT) in 2000 to 3.4 MT in 2012 with annual per capita consumption increasing from 0.8 kg to 2.8 kg during the same period. Table egg production is estimated to have increased from 30 Bn eggs in 2000 to 67 Bn eggs in 2012 with per capita egg consumption increasing from 28 to 55 eggs during that period. Just to give you an idea for comparison, annual per capita meat consumption in developed countries is 70-80 kg. India produces nearly 27 Mn chickens a week (95% traded alive).

The healthy growth in poultry output over the last decade makes India one of the fastest-growing major world markets in the segment with future growth potential remaining strong on the back of a wide gap against global per capita consumption norms and favorable socio-economic and demographic factors.

VALUATION

Hester Biosciences Ltd is currently trading at 480 per share with a market capitalization of 427 Cr. It has total debt of 58.19 Cr with long-term Debt to Equity of 0.3. It has total cash and bank balance of 8.09 Cr.

HBL is the only listed company in India doing business exclusively in animal health. HBL has crossed the inflection point and has entered into a high growth phase. The FAO’s PPR eradication program presents a tremendous opportunity for HBL to augment its vaccine sales worldwide. Hester is leveraging this opportunity well by planning ahead and establishing relationships and distribution networks in the African continent.

Revenues are expected to soar by about 45% during FY16E and by about 65% during FY17E over the previous year, primarily driven by PPR vaccines sales in Africa and significant growth in domestic sales and exports of poultry vaccines as well as robust growth in animal health products, which would pick up at a faster pace in domestic markets. Exports of poultry vaccines sales are expected to deliver strong sales because HBL has recently gotten approval for 14 poultry vaccines in four different countries and currently exports to about 17 countries.

Total meat production has been growing strongly at a 10-year CAGR of 11% over FY04-FY13. This further expands the vaccines opportunity from poultry to other livestock as well. HBL started marketing the PPR vaccine (Sungri strain) in March 2015, furthermore, HBL became the first company in India to manufacture goat pox vaccine. The goat population in India is about 140 Mn heads and the market size for goat pox vaccine is about Rs. 700 Mn. The population of Sheep and Goats is about 200 Mn and the market size of the PPR vaccine in India is about 400 Mn. HBL is looking to aggressively market PPR and goat pox vaccines in India.

The total poultry vaccines market in India is around Rs.3-3.5 Bn, growing at 15-20% per annum. HBL is expected to grow faster than the poultry vaccines market during FY16E and FY17E. HBL’s poultry vaccines sales grew at a robust 19% CAGR over FY09-15. Margins in poultry vaccines continue to remain strong in the region of 29% to 30% and poultry vaccines segment continues to be highest contributor with 93% of total revenue during FY15.

|

Co_Name |

Year End[Late st] |

Latest Market Price |

Market Cap |

Net Sales 15` |

Net Sales 14` |

Net Sales change |

EBIDT 15` |

EBIDT 14` |

EBIDT change |

EPS 15` |

EPS 14` |

EPS change |

Latest EPS (cons.) |

Latest P/E |

Latest P/BV - cons |

|

Neuland Labs. |

201503 |

688.25 |

611.39 |

445.06 |

453.85 |

-1.94% |

67.4 |

74.05 |

-8.98% |

18.67 |

30.89 |

- 39.56% |

17.9 |

38.46 |

3.81 |

|

Hester Bios |

201503 |

487.25 |

414.65 |

89.51 |

69.05 |

29.63% |

26.91 |

25.24 |

6.62% |

14.21 |

10.77 |

31.94% |

10.96 |

44.44 |

5.03 |

|

Claris Lifescien |

201503 |

188.4 |

1028.06 |

780.11 |

625.39 |

24.74% |

241.78 |

204.45 |

18.26% |

25.89 |

23.76 |

8.96% |

26.64 |

7.07 |

0.78 |

We value HBL using DCF at price of 567 with expected growth rate at 24.35% per annum. For valuation we assume that over the period company will keep capital structure unaltered and tax rate unchanged.

CONCUSSION AND RECOMMENDATION

Hester plans to expand the business of its health products to a large scale and expects that health products will contribute more sales rupees than will vaccines in years to come. In light of these opportunities, the big picture of HBL looks ‘exciting’. With Superior project management skills, focus on measuring and monitoring quality and its planned expansion, we believe HBL will expand further. We recommend BUY on the stock at CMP of Rs. 480 to target of Rs. 957.

RISKS AND CONCERNS

-

Delayed/No product registration in African and other countries where PPR eradication strategy is implanted.

-

Significant delay in manufacturing and exporting vaccines at the Nepal facility.

-

HBL not able to win PPR vaccine tenders in Africa.

-

Failure/Delayed response to address growing demand for animal vaccines both in India and worldwide on account of capacity shortage.

-

Slow/ Delayed capacity expansion in response to address the animal vaccines demand both in India and worldwide at manufacturing facilities.

-

Failure to establish effective cold storage and distribution network in Africa and other countries where HBL intends to sell vaccines.

FINANCIALS

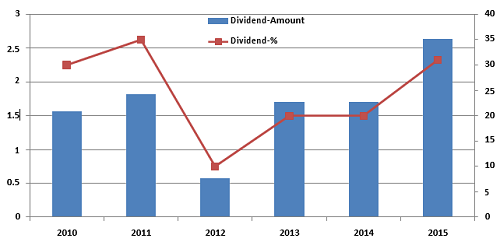

Hester Biosciences Ltd. key Products/Revenue Segments include Poultry vaccines which contributed Rs 85.72 Cr to Sales Value (92.89% of Total Sales), Animal Health Products which contributed Rs 5.42 Cr to Sales Value (5.87% of Total Sales), Sale of services which contributed Rs 1.13 Cr to Sales Value (1.22% of Total Sales), for the year ending 31-Mar-2015.

For the quarter ended 30-Sep-2015, the company has reported a Standalone sales of Rs. 23.02 Cr., down -6.15% from last quarter Sales of Rs. 24.53 Cr. and up 7.12% from last year same quarter Sales of Rs. 21.49 Cr. Company has reported net profit after tax of Rs. 4.30 Cr. in latest quarter.

|

Yearly Income Statement |

2012 |

2013 |

2014 |

2015 |

2016 E |

2017 E |

|

Net Sales |

48.26 |

65.1 |

69.05 |

89.51 |

111.31 |

138.41 |

|

Other Income |

0.25 |

0.24 |

0.61 |

2.95 |

3.00 |

3.00 |

|

Other Operating Income |

0 |

0 |

0 |

1.13 |

1.13 |

1.13 |

|

Total Income |

48.51 |

65.34 |

69.66 |

93.59 |

115.44 |

142.54 |

|

Total Expenditure |

29.66 |

43.64 |

44.41 |

66.68 |

82.64 |

102.42 |

|

Raw Material Consumed |

11.92 |

14.72 |

10.36 |

15.48 |

- |

- |

|

Stock Adjustment |

-5.15 |

-2.46 |

-3.03 |

5.98 |

- |

- |

|

Purchase of Finished Goods |

0.67 |

3.18 |

4.02 |

3.72 |

- |

- |

|

Employee Expenses |

6.87 |

9.06 |

9.84 |

11.25 |

- |

- |

|

Selling & Administrative Expenses |

6.6 |

9.8 |

11.57 |

16.1 |

- |

- |

|

Other Expenses |

8.75 |

9.34 |

11.65 |

14.15 |

- |

- |

|

EBIDTA |

18.85 |

21.70 |

25.25 |

26.91 |

32.79 |

40.12 |

|

Depreciation |

4.12 |

4.03 |

5.42 |

5.96 |

7.50 |

9.27 |

|

EBIT |

14.73 |

17.67 |

19.83 |

20.95 |

25.29 |

30.85 |

|

Interest |

2.83 |

3.26 |

6.46 |

4.83 |

6.12 |

6.92 |

|

PBT |

11.9 |

14.41 |

13.36 |

16.13 |

19.17 |

23.93 |

|

Tax |

4.41 |

5.34 |

4.2 |

4.04 |

4.79 |

5.98 |

|

Deferred Tax |

0 |

0 |

0 |

0 |

0 |

0 |

|

Adjusted Profit After Tax |

7.49 |

9.07 |

9.16 |

12.09 |

14.37 |

17.95 |

|

Minority Interest After NP |

0 |

0 |

0 |

0 |

0 |

0 |

|

Profit/Loss of Associate Company |

0 |

0 |

0 |

0 |

0 |

0 |

|

Extra-ordinary Items |

0 |

0 |

0 |

1.98 |

0 |

0 |

|

Adjusted Profit After Extra-ordinary item |

7.49 |

9.07 |

9.16 |

12.09 |

14.37 |

17.95 |

|

|

|

|||||

|

Equity |

5.67 |

8.51 |

8.51 |

8.51 |

8.51 |

8.51 |

|

EPS (Unit Curr.) |

8.80 |

10.66 |

10.77 |

14.21 |

16.90 |

21.10 |

|

Face Value |

10 |

10 |

10 |

10 |

10 |

10 |

|

Outstanding Shares |

|

|

|

8506800 |

8506800 |

8506800 |

|

|

|

|||||

|

EBIDTA Margin |

39.06% |

33.33% |

36.57% |

30.06% |

29.46% |

28.98% |

|

EBIT Margin |

30.52% |

27.14% |

28.72% |

23.41% |

22.72% |

22.29% |

|

PAT Margin |

15.44% |

13.88% |

13.15% |

12.92% |

12.45% |

12.59% |

BALANCE SHEET

|

SOURCES OF FUNDS : |

201503 |

201403 |

|

Share Capital |

8.51 |

8.51 |

|

Reserves Total |

73.89 |

66.5 |

|

Equity Share Warrants |

0 |

0 |

|

Equity Application Money |

0 |

0 |

|

Total Shareholders Funds |

82.4 |

75.01 |

|

Minority Interest |

1.46 |

1.28 |

|

Secured Loans |

53.91 |

43.57 |

|

Unsecured Loans |

4.28 |

4.7 |

|

Total Debt |

58.19 |

48.27 |

|

Policy Holders Fund |

0 |

0 |

|

Other Liabilities |

0.54 |

0.01 |

|

Total Liabilities |

142.59 |

124.57 |

APPLICATION OF FUNDS

|

Gross Block |

97.64 |

86.69 |

|

Less: Accumulated Depreciation |

38.43 |

32.87 |

|

Net Block |

59.21 |

53.82 |

|

Lease Adjustment |

0 |

0 |

|

Capital Work in Progress |

31.8 |

20.55 |

|

Producing Properties |

0 |

0 |

|

Investments |

0.28 |

0.28 |

|

Current Assets, Loans & Advances |

|

|

|

Inventories |

29.11 |

35.59 |

|

Sundry Debtors |

18.42 |

14.06 |

|

Cash and Bank |

8.09 |

4.85 |

|

Loans and Advances |

1.51 |

2.59 |

|

Total Current Assets |

57.13 |

57.1 |

|

Less : Current Liabilities and Provisions |

|

|

|

Current Liabilities |

7.89 |

8.93 |

|

Provisions |

3.92 |

3.8 |

|

Total Current Liabilities |

11.81 |

12.73 |

|

Net Current Assets |

45.32 |

44.37 |

|

Miscellaneous Expenses not written off |

0 |

0 |

|

Deferred Tax Assets |

0.11 |

0.1 |

|

Deferred Tax Liability |

5.44 |

5.02 |

|

Net Deferred Tax |

-5.33 |

-4.92 |

|

Other Assets |

11.32 |

10.47 |

|

Total Assets |

142.6 |

124.57 |

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.