Federal Bank Limited Research Report

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Bank |

111 |

Buy |

147 |

1-Year |

Federal Bank - Q1 FY 2023 Review

Federal Bank Limited reported net revenue of ₹3,843.09 crores for the quarter ended June 30, 2022, compared to ₹3,524.98 crores for June 30, 2021. Profit After Tax was ₹634.22 crores for the quarter ended June 30, 2022, compared to ₹356.76 crores during the corresponding quarter of the previous year, respectively.

Federal Bank - Investment Summary

|

CMP (₹) |

111 |

|

52 Week H/L |

78.60/116 |

|

Market Cap (crores) |

23,412 |

|

Face Value (₹) |

2.00 |

|

Promoter Holding (%) |

0 |

|

Non-Promoter Holding (%) |

100 |

|

Total (%) |

100.00 |

|

Book Value |

₹92.33 |

|

EPS TTM |

₹9.44 |

Federal Bank - Overview

-

An established, mid-sized private bank, The Federal Bank Limited (FBL), primarily conducts business in Kerala.

-

The bank has 1,291 branches and 1,860 ATMs/recyclers as of June 30, 2022.

-

In relation to the Bank's "Basel III -Tier II Bonds" of Rs. 1000 Crores (Size of Issue), CARE Ratings has reaffirmed the "CARE AA" Rating and changed the outlook from "stable" to "positive."

Beta: 0.96 |

Alpha: -5.89 |

Risk Reward Ratio: 1.58 |

Margin of Safety: 24% |

Federal Bank - Quarterly Summary

|

Quarterly (INR in crores) |

Jun-22 |

Mar-22 |

Dec-21 |

Sep-21 |

Jun-21 |

|

Interest Income |

3,843.09 |

3,686.30 |

3,604.23 |

3,566.27 |

3,524.98 |

|

Interest Expended |

2,103.76 |

2,029.95 |

2,075.79 |

1,959.47 |

2,000.16 |

|

Net Interest Income |

1,739.33 |

1,656.35 |

1,528.44 |

1,606.80 |

1,524.82 |

|

|

|

|

|

|

|

|

Other Income |

475.08 |

484.25 |

484.54 |

494.48 |

620.90 |

|

Total Income |

2,214.41 |

2,140.60 |

2,012.98 |

2,101.28 |

2,145.72 |

|

|

|

|

|

|

|

|

Employee Cost |

558.37 |

689.54 |

562.10 |

617.85 |

569.90 |

|

Other Expenses |

617.43 |

589.30 |

448.68 |

515.02 |

419.65 |

|

Provision and Contingencies |

175.21 |

83.94 |

439.34 |

311.82 |

669.11 |

|

EBT |

863.40 |

777.82 |

562.86 |

656.59 |

487.06 |

|

|

|

|

|

|

|

|

Tax Expenses |

220.40 |

196.06 |

143.19 |

168.60 |

131.50 |

|

PAT before Minority Interest & Share in Profit/(Loss) of Associates |

643.00 |

581.76 |

419.67 |

487.99 |

355.56 |

|

|

|

|

|

|

|

|

Minority Interest |

-11.04 |

-11.37 |

-3.94 |

-6.85 |

-3.84 |

|

Share in Profit/(Loss) of Associates |

2.26 |

17.15 |

2.41 |

4.58 |

5.04 |

|

Net Profit |

634.22 |

587.54 |

418.14 |

485.72 |

356.76 |

Business

-

On April 23, 1931, the Bank was established under the Travancore Companies Regulation, 1916 as the Travancore Federal Bank Limited Nedumpram. After taking over in 1945, the late K.P. Hormis, the bank's founder and visionary banker, grew it into a major institution across the country.

-

On December 2, 1949, the Bank's name was changed to The Federal Bank Limited.

-

On July 11, 1959, the Bank received a license under the Banking Regulation Act, 1949, and on July 20, 1970, it was designated as a scheduled commercial bank under the Second Schedule of the Reserve Bank of India Act, 1934.

-

Federal Bank established its first foreign representative office in Abu Dhabi in January 2008.

-

In November 2015, Federal Bank established its International Financial Service Centre (IFSC) Banking Unit (IBU) in GIFT City, Gujarat, the country's first IFSC. Since the International Banking Unit (IBU) Branch at GIFT City (Gujarat International Financial Tec-City) opened, the bank has provided importers with buyer's credit at a discounted rate.

-

The Bank's paid-up capital increased by ₹ 43.10 crores in FY 2017–18 through the distribution of 21.55 crores equity shares worth ₹ 2 each that were acquired through qualified institutional placement.

-

The GPTW® Institute recognized Federal Bank Limited as a Great Place to Work in 2022.

-

The Bank is listed on the London Stock Exchange, the National Stock Exchange of India, and BSE Limited.

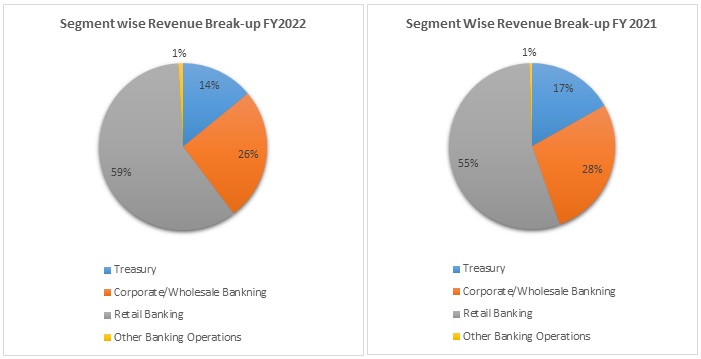

The business segment of Federal Bank Limited is as follows:

-

Corporate/ Wholesale Banking:

-

The section includes lending money, accepting deposits, and providing other banking services to corporations, trusts, partnership businesses, and statutory organizations that are not included in the retail banking segment.

-

Interest on loans given to these clients and fees levied by other banking services are the main sources of revenue for this sector.

-

-

Retail Banking:

-

Retail banking includes lending money, accepting deposits, and providing other banking services to any legal person, including small business clients, depending on the borrower's status, the product, the level of risk involved, and the amount involved.

-

Interest on loans given to these clients plus fees/charges from other banking services, such as para-banking activities, make up the segment's revenue.

-

-

Treasury:

-

Trading and investing in corporate debt, government securities, mutual funds, derivatives, and foreign currency operations for both internal use and client accounts are all part of the Treasury's operations.

-

Gains, losses, margins, fees/charges on trading and foreign exchange activities, along with interest from the bank's investment portfolio, make up the majority of this segment's revenue.

-

-

Other Banking Operations:

-

Banking transactions that fall outside of the aforementioned sectors are included in this category. This division discloses the revenue from such services as well as any related expenses.

-

-

-

Out of the total revenue, 26% has been generated from Corporate/Wholesale banking, 59% from Retail Banking, 14% from Treasury, 4%, and 1% from Other Banking Operations in FY 2022 compared to 28%, 55%, 17%, and 1% in FY 2021, respectively.

SWOT ANALYSIS

-

Strength

-

Experienced Management.

-

Strong customer base.

-

Strong Profit growth from past few years.

-

Widespread network.

-

-

Weakness

-

Zero Promoter shareholding.

-

Less market penetration in cities.

-

High-interest expense compared to net interest income.

-

-

Opportunity

-

Ability to improve urban service.

-

Investment in digital technology.

-

Can come up with new unique schemes.

-

Increasing capital expenditure by the companies.

-

-

Threat

-

Increasing competition in the financial sector.

-

Ongoing uneven circumstances globally (e.g., Inflation).

-

Federal Bank - Revenue Trend

Federal Bank - Ratio Analysis

|

|

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Interest Income |

2.88% |

2.86% |

3.03% |

2.98% |

|

Gross NPA |

1.94% |

2.16% |

3.00% |

3.00% |

|

Net NPA |

1.50% |

1.31% |

1.19% |

0.96% |

|

Provision Coverage Ratio |

50.10% |

51.30% |

49.40% |

53.30% |

|

Capital Adequacy Ratio |

14.10% |

14.00% |

14.62% |

15.77% |

|

CASA Ratio |

32.40% |

30.70% |

34.00% |

36.90% |

|

ROA |

0.88% |

0.92% |

0.86% |

0.91% |

|

ROE |

10.21% |

11.16% |

10.63% |

11.02% |

|

Cost to Income Ratio |

58.72% |

59.97% |

55.64% |

54.75% |

Federal Bank - Financial Overview

Federal Bank - Profit and Loss Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Interest income |

9,914.90 |

11,635.44 |

13,590.39 |

14,314.08 |

14,381.53 |

|

Interest Expended |

6,226.42 |

7,316.33 |

8,678.31 |

8,434.96 |

7,959.38 |

|

Net Income |

3,688.48 |

4,319.11 |

4,912.08 |

5,879.12 |

6,422.15 |

|

|

|||||

|

Other income |

1,160.22 |

1,335.22 |

1,881.81 |

1,971.65 |

2,120.93 |

|

Total income |

4,848.70 |

5,654.33 |

6,793.89 |

7,850.77 |

8,543.09 |

|

|

|||||

|

Other expenses |

2,504.74 |

2,836.58 |

3,546.71 |

3,898.66 |

4,592.15 |

|

Provision and Contingencies |

1,434.31 |

1,535.23 |

1,694.42 |

2,304.90 |

1,985.54 |

|

PAT before Share in Profit/(Loss) of Associates & Minority Interest |

909.64 |

1,282.52 |

1,552.77 |

1,647.21 |

1,965.40 |

|

|

|||||

|

Share of Minority Interest |

- |

-1.80 |

-10.28 |

-15.24 |

-26.64 |

|

Share in Profit/(Loss) of Associates |

25.79 |

35.56 |

37.71 |

32.36 |

31.03 |

|

Net Profit |

935.44 |

1,316.29 |

1,580.20 |

1,664.33 |

1,969.79 |

|

|

|||||

|

EPS |

|||||

|

Basic |

4.92 |

6.65 |

7.94 |

8.34 |

9.52 |

|

Diluted |

4.86 |

6.61 |

7.88 |

8.31 |

9.44 |

|

|

|||||

|

Number of shares |

|||||

|

Basic |

190.22 |

198.02 |

198.90 |

199.45 |

206.92 |

|

Diluted |

192.63 |

199.26 |

200.41 |

200.17 |

208.56 |

Federal Bank - Cash Flow Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Profit Before Tax |

1,418.99 |

1,993.87 |

2,087.39 |

2,225.69 |

2,650.67 |

|

Net Cash from Operating Activities |

-5,050.92 |

7,872.64 |

3,730.57 |

11,179.03 |

-7,773.65 |

|

Net Cash Used for Investing Activities |

-1,579.27 |

-3,380.02 |

-4,692.57 |

-3,914.91 |

907.73 |

|

Net Cash From (Used For) Financing Activities |

8,370.62 |

-3,636.61 |

3,661.48 |

-207.61 |

8,192.64 |

|

Net Increase in Cash and Cash Equivalents |

1,740.59 |

858.26 |

2,703.85 |

7,058.43 |

1,320.37 |

|

Cash And Cash Equivalents at The Beginning of the Year |

7,454.64 |

9,195.23 |

10,053.49 |

12,757.33 |

19,815.76 |

|

Cash And Cash Equivalents at The End of the Year |

9,195.23 |

10,053.49 |

12,757.33 |

19,815.76 |

21,136.13 |

Federal Bank - Balance Sheet (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

CAPITAL AND LIABILITIES |

|

|

|

|

|

|

Capital |

394.43 |

397.01 |

398.53 |

399.23 |

420.51 |

|

Reserve and Surplus |

11,879.81 |

13,101.24 |

14,423.83 |

16,104.72 |

18,835.01 |

|

Minority Interest |

- |

80.46 |

180.96 |

217.04 |

305.33 |

|

Deposits |

1,11,970.10 |

1,34,878.93 |

1,52,251.91 |

1,72,186.10 |

1,81,677.52 |

|

Borrowings |

12,328.84 |

8,706.29 |

12,527.72 |

12,270.60 |

19,587.39 |

|

Other Liabilities and Provisions |

2,640.50 |

3,388.53 |

3,570.38 |

3,788.83 |

5,415.29 |

|

Total |

1,39,213.67 |

1,60,552.47 |

1,83,353.33 |

2,04,966.53 |

2,26,241.04 |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Cash and Balances with Reserve Bank of India |

5,136.79 |

6,422.67 |

6,182.54 |

7,654.51 |

10,016.11 |

|

Balances with Banks and Money at Call and Short Notice |

4,058.43 |

3,630.80 |

6,574.77 |

12,161.22 |

11,119.99 |

|

Investments |

30,594.68 |

31,675.70 |

35,715.39 |

36,731.67 |

39,065.19 |

|

Advances |

93,010.89 |

1,11,535.92 |

1,24,849.50 |

1,35,514.41 |

1,49,951.46 |

|

Fixed Assets |

461.35 |

479.93 |

504.81 |

517.49 |

672.10 |

|

Other Assets |

5,951.55 |

6,807.45 |

9,526.31 |

12,387.22 |

15,416.18 |

|

Total |

1,39,213.67 |

1,60,552.47 |

1,83,353.33 |

2,04,966.53 |

2,26,241.04 |

Industry Overview

-

The NPA ratio for public sector banks decreased from 9.4% in June 2021 to 7.2% in June 2022, while it decreased from 4.2% to 3.1% in the same month for private banks.

-

Early in June 2022, yearly growth in bank lending by scheduled commercial banks (SCBs) reached 13.1% as the Indian economy struggled to recover from pandemic waves. The catalyst has been wholesale credit, which changed its decreasing trend from a year ago to one of double-digit growth. At the same time, retail credit growth remained healthy.

-

In the banking industry, private sector banks continue to outperform their counterparts in the public sector in terms of loan growth, both wholesale and retail.

-

Asset quality in the banking sector has increased during the past year, helped by an uptick in economic activity. Even if concerns about restructured credit persist, bad loans decreased by around 185 basis points to 5.7% of all loans.

-

Non-performing assets (NPAs) are on a relatively low level on banks' balance sheets drop for both wholesale and retail loans and enough capital buffers. In a dynamic climate marked by significant uncertainty, the drop in risk-weighted assets shows that banks are still cautious about the risk profile of borrowers.

-

The Morgan Stanley study stated that "strong balance sheets, waning economic concerns, and better capacity utilization lay the scenario for a Capex up-cycle in FY24-FY25, which might fuel a second leg of rerating at Indian banks."

-

S&P Global Ratings projected that bad loans in India’s banking sector will decline to 5%-5.5% of gross loans by 31 March 2024. Credit costs are predicted to settle around 1.5% for FY23 and then normalize further to 1.3%, bringing them comparable to those of other emerging economies and to the 15-year average for India.

-

According to rating agency ICRA, bank bad loan ratios are anticipated to further decrease to 5.2–5.3% by 31 March 2023 due to a lower slippage rate and stronger credit growth.

Concall Overview (Q1FY2023)

-

Asset quality is high, and management is confident that momentum will persist even during what may initially appear to be a difficult period.

-

In the third consecutive quarter that the bank's ROA increased, it reached 1.1%. Management anticipates continuing growth in the ROA in the next quarters.

-

There has already been a demand for Rs. 1,300 crores of the restructured book.

-

Bank opened 10 branches in Q1FY 2023. The management has committed to opening around 65 branches this fiscal year, and management anticipates opening 200 to 250 branches over the following three fiscal years, including this one.

-

The management expects them to expand into one to two additional regions where they are already fairly powerful and dominant.

-

Employee costs for FY 2023 may be in the range of Rs. 2500-2200 crores, according to management.

-

The forecasted aggregate slippages for FY 2023 are roughly 18%.

-

The share of retail deposits of the total deposits is around 92%.

Federal Bank - Technical Analysis

-

Stock is trading above EMA 200 and MA 200 indicators, with a support level of ₹106 and a resistance level of ₹116.

-

Share is trading in an upward trend on weekly and monthly charts.

-

One can accumulate this stock at current levels.

Peers Comparison

|

|

FY-2022 |

|||

|

|

GNPA |

NPA |

ROA |

ROE |

|

HDFC Bank Limited |

1% |

0.32% |

1.79% |

15.38% |

|

ICICI Bank Limited |

4% |

0.76% |

1.43% |

14.04% |

|

Federal Bank Limited |

3% |

0.96% |

0.91% |

11.02% |

Recommendation Rationale

-

To implement its development plan of expanding into numerous products and regions, taking exposure to higher-rated corporates, and extending its wholesale lending advances book, the bank has added experienced individuals to its executive team.

-

The loan portfolio of FBL increased steadily from FY18 to FY22 at a compound annual growth rate (CAGR) of 12.20%, reaching crore ₹1,49,951.46 as of March 31, 2022. The bank intends to grow unsecured loans in the future, although the proportion is anticipated to remain relatively low. The bulk of the FBL's gross advances is secured. In order to do this, FBL has partnered with various fintech businesses and entered the market for goods like credit cards, microloans, and personal loans.

-

The bank reported a net profit of ₹645 crores for the first quarter of FY23 on total revenues of ₹4,318 crores, up from a net profit of ₹361 crores on total revenues of ₹4,049 crores for the same period of FY22. The decrease in credit expenses for the quarter was considerable, which allowed the bank to compensate for the decrease in non-interest revenue.

-

The bank intends to keep its CET-I ratio over 12% and would consider boosting equity capital when it approaches the threshold. The bank has plenty of opportunity to raise more Tier-I capital to support expansion in its business portfolio because of the robust Tier-I capital composition.

-

High slippages were seen by the bank during Q1FY23, i.e., ₹444 crores compared to ₹358crores in Q4FY22. Future major rating monitorable factors will be the bank's ability to sustain asset quality when it expands its advances and introduces new products like credit cards and commercial vehicle (CV) lending.

-

As of June 30, 2022, the bank has a network of 1,291 branches, of which 596 are located in Kerala. As of March 31, 2022, Kerala alone accounted for 33% of the total advances, followed by Maharashtra at 22% and Tamil Nadu at 14%. The portfolio of the advances is geographically concentrated, and the bank can be affected.

-

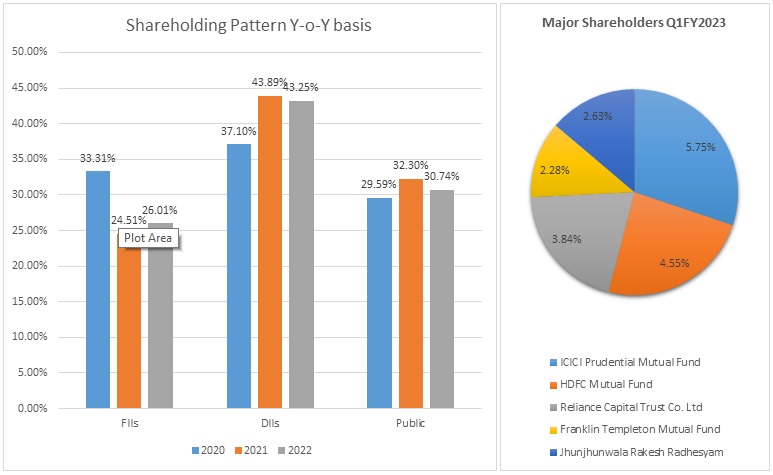

Federal Bank has zero promoter shareholding and FIIs holding is 26.20%. Due to uneven certainties globally, like increasing inflation and interest rates, FIIs can sell their stake from the Indian stock exchange, which could hamper the bank’s share price.

Valuation

-

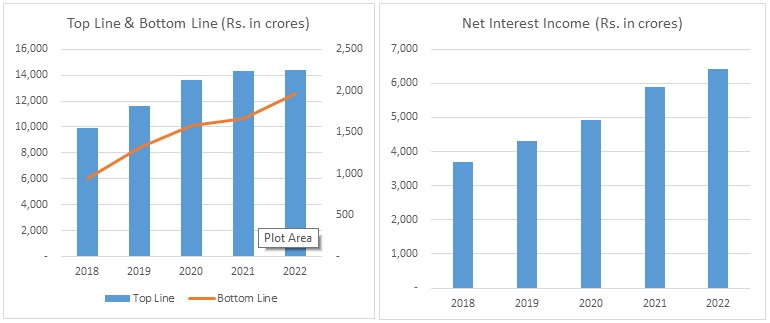

The Bank’s Net Interest Income has grown at a CAGR of 15% from FY 2018-2022.

-

The Bank’s Net Profit has grown at a CAGR of 20% from FY 2018-2022.

-

The bank’s return on average net worth has remained between 10%-11% from FY 2018–22.

-

Bank’s revenue and net profit Q-o-Q basis have consistently increased for the last 5 quarters.

-

We anticipate the company could generate higher Net Interest income for the following FY 2023, comparable to the prior year, based on the company's present performance in FY 2022.

-

We used data from the last five years (2018-2022) to anticipate revenue for the fiscal years 2023–2027.

Federal Bank - Estimated Income Statement (₹ in crores)

|

|

Mar-23 |

Mar-24 |

Mar-25 |

Mar-26 |

Mar-27 |

|

|

2023-E |

2024-E |

2025-E |

2026-E |

2027-E |

|

Interest income |

15,783 |

17,321 |

19,008 |

20,860 |

22,893 |

|

Interest Expended |

8,463 |

8,999 |

9,569 |

10,175 |

10,819 |

|

Net Interest Income |

7,320 |

8,322 |

9,439 |

10,686 |

12,074 |

|

|

|

|

|

|

|

|

Other income |

2,252 |

2,391 |

2,538 |

2,695 |

2,861 |

|

Total income |

9,571 |

10,712 |

11,978 |

13,381 |

14,936 |

|

|

|

|

|

|

|

|

Other expenses |

4,668 |

5,102 |

5,577 |

6,097 |

6,666 |

|

Provision and Contingencies |

2,361 |

2,581 |

2,821 |

3,084 |

3,372 |

|

PAT |

2,542 |

3,030 |

3,580 |

4,200 |

4,898 |

-

We initiate coverage on Federal Bank Limited with a “Buy” and a 1-year Target Price of ₹147.

Disclaimer: This report is only for the information of our customers Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.