Colgate Palmolive (India) Ltd.

Colgate-Palmolive - Fundamental Report

Colgate-Palmolive (India) Ltd., incorporated in the year 1937, is a Large Cap company operating in Personal Care sector.

It manufactures and sells oral care and personal care products primarily in India. It offers oral care products, including toothpastes, toothbrushes, toothpowder, whitening products, mouthwash, and kid’s products.

|

Key Parameters |

|

|

BSE Code |

500830 |

|

NSE Code |

COLPAL |

|

Reuters Code |

COLG.NS |

|

INCEPTION |

1937 |

|

Industry |

Consumer Goods / Personal Products |

|

IPO |

1978 |

|

CMP (as on 24/09/2015) |

953 |

|

Stock Beta |

0.4662 |

|

52 Week L/H |

810 /1099 |

|

Market Cap (Cr) |

26,700 |

|

Equity Capital (Rs Cr) |

13.60 |

|

Face Value (Rs) |

1.00 |

|

Average Volume |

1,27,000 |

|

|

|

|

Shareholding Pattern (%) |

|

|

Promoters |

51.00 |

|

Non Institutions |

49.00 |

|

Grand Total |

100.00 |

Colgate-Palmolive - Potential Catalysts

-

Innovation for growth

-

Predominance in oral care proceeds with sustained overall market share

-

Engaging with consumers to build brands and Increasing Distribution & availability

-

High payout and solid return proportions

Colgate-Palmolive - Recommendation

Based on the strong product portfolio and geographically diversified presence, we value the stock at 48.5x FY16 EPS, which gives a target price of Rs 1083. We feel that investors could buy the stock at the CMP for the given target prices for FY16.

Colgate-Palmolive - Financial Summary

|

Income Statement Yearly |

2014 |

2015 |

2016 E |

2017 E |

|

Revenue |

3693.51 |

4015.11 |

4536.95 |

5130.38 |

|

EBIDTA |

778.71 |

855.41 |

1012.15 |

1138.55 |

|

EBIT |

727.96 |

780.39 |

922.07 |

1036.61 |

|

Profit After Tax |

539.87 |

558.98 |

685.59 |

769.19 |

|

EPS |

39.7 |

39.64 |

48.62 |

54.55 |

|

EBIDTA M(%) |

21.76% |

21.48% |

22.47% |

22.34% |

|

EBIT M(%) |

20.34% |

19.60% |

20.47% |

20.34% |

|

PATM(%) |

13.32% |

13.92% |

15.11% |

14.99% |

BUSINESS DISCRIPTION

Colgate Palmolive (India) Limited is an India-based company that is engaged in the personal care and oral care business. Its personal care products include soaps, cosmetics, toilet preparations, body wash, liquid hand wash, skin care and hair care, among others, oral care products include toothpastes, toothbrushes, toothpowder, whitening products and mouthwash and household care product includes surface care. Its portfolio of products includes Colgate Sensitive Pro-Relief (CSPR) Enamel Repair Toothpaste, Colgate Visible White Plus Shine Toothpaste, Colgate SlimSoft Charcoal Toothbrush, Colgate ZigZag Black Toothbrush, Colgate Plax Active Salt Mouthwash and Colgate Active Salt Neem, among others. COLPAL has set up two manufacturing facilities at Sanand, Gujarat and Sricity, Andhra Pradesh to manufacture toothpaste and toothbrush.

MANAGEMENT & GOVERNANCE

|

Top Management |

|

|

Name |

Designation |

|

R A Shah |

Vice Chairman |

|

P K Ghosh |

Deputy Chairman |

|

J K Setna |

Director |

|

V S Mehta |

Director |

|

M V Deoras |

Chairman |

|

N Ghate |

Whole-time Director & CS |

|

Indu Shahani |

Director |

|

Godfrey Nthunzi |

Whole Time Director & CFO |

|

I Bachaalani |

Managing Director |

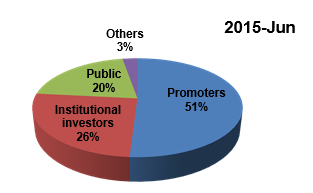

Shareholding pattern as on 30thJune, 2015

|

|

2015-Jun |

2015-Mar |

2014-Dec |

|

Promoters |

51 |

51 |

51 |

|

Institutional investors |

25.65 |

25.65 |

26.62 |

|

Public |

20.59 |

20.51 |

20.55 |

|

Others |

2.76 |

2.84 |

1.83 |

INVESTMENT RATIONALE

Predominance in oral care proceeds with sustained overall market share with Expanding infiltration, per-capita utilization to help development

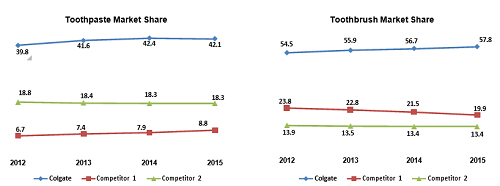

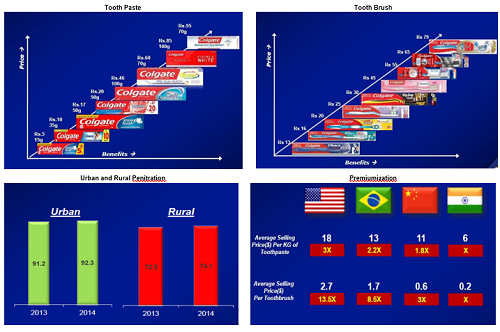

Driven by the predominance of CPIL in toothpastes with a vicinity over premium, well known and mass classes and having SKUs crosswise over variations (consistent, touchy, natural, brightening, gum care, freshness), CPIL's business sector offer in toothpaste has reinforced from 49.4% in FY08 to 56.7% in FY14.

The oral care industry in India has been largely dominated by the toothpaste segment. Toothbrush is the second largest oral care products segment in the industry after toothpaste and majorly including products such as manual and electric toothbrushes. Colgate India has maintained its strong presence in the domestic toothbrush market for past many decades with a maximum share of ~40% in FY'2015.

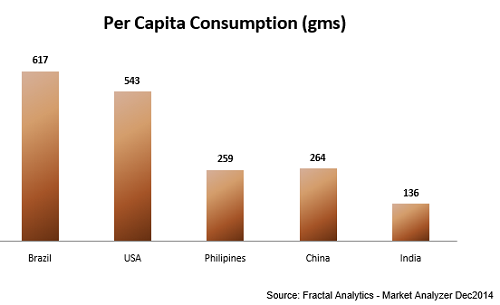

Bellow is the Per Capita Consumption of Toothpaste (Year 2014)

Engaging with consumers to build brands and Increasing Distribution & availability

Behind Colgate-Palmolive’s, innovation, the company seeks to engage consumers in building awareness of the brand. In order to attract consumers in retail stores, Colgate has increased its commercial investment in advertising, promotions, trade spending, and creative brand building along with In-store advertising, Investment in Digital Space.

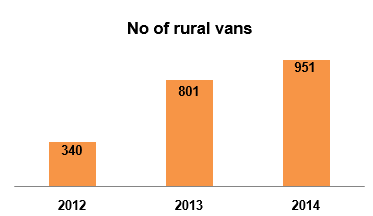

It has increased its presence in rural India. It has been helping people to build awareness by doing road shows also using Corporate Social Responsibility (CSR) to gain competitive advantage. Frequently, though, CSR efforts are counterproductive, for two reasons. First, they pit business against society, when in reality the two are interdependent. Second, they pressure companies to think of corporate social responsibility in generic ways instead of in the way most appropriate to their individual strategies.

It is investing behind infrastructure to promote awareness by increasing distribution and availability. Colgate is now available in almost 48 lakh outlets.

Innovation

Over the years, Colgate has built an extensive oral care portfolio through constant innovation thereby offering products across value pyramid and within each sub-category (sensitive toothpaste, gum care toothpaste electric brush, kids brush etc.). Lately, it has been aggressive on extension of its premium portfolio to capture upgrading consumers. In FY15, it launched toothpastes (Visible White Plus Shine, Sensitive Pro- Relief Enamel Repair, Sugar Acid Neutralizer) and two varieties of toothbrushes (Slimsoft Charcoal, Zig Zag Black). Hence, with constant innovation and higher A&P spends, we believe Colgate would continue to remain the dominant player and would be the largest beneficiary of increasing penetration levels in India.

Innovation to create new segments (few new products announced)

-

Whiter + Shinier teeth

-

Sensitivity – repairs enamel for lasting sensitivity relief

-

Premium Anti-Cavity – Fights Sugar Acids

-

Deep & Gentle Cleaning, with Charcoal Infused Bristles.

-

Deep cleaning between teeth – First mass ‘black” toothbrush.

Innovating to drive Permiumization

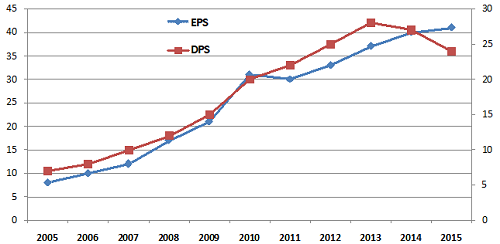

High payout and solid return proportions

One of the advantages to shareholders in the respect of stock dividends is the tax benefit. The receipt of the stock dividends by the shareholder is not taxable as income. The payment of stock dividend is normally interpreted by shareholders as an indication of higher profitability.

In the present unpredictable market conditions, picking stocks with high dividend yields is a good strategy for those who are here to invest with a long-term goal as such stocks gives investors fairly regular dividends, plus the capital appreciation could also be fairly good.

|

|

EPS |

DPS |

|

2005 |

8 |

7 |

|

2006 |

10 |

8 |

|

2007 |

12 |

10 |

|

2008 |

17 |

12 |

|

2009 |

21 |

15 |

|

2010 |

31 |

20 |

|

2011 |

30 |

22 |

|

2012 |

33 |

25 |

|

2013 |

37 |

28 |

|

2014 |

40 |

27 |

|

2015 |

41 |

24 |

|

|

10 Yr CAGR -17% |

10 Yr CAGR -13% |

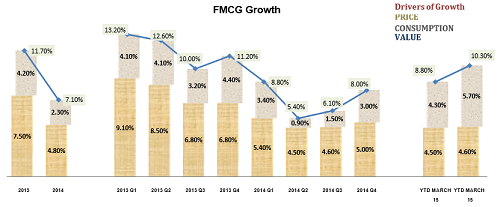

INDUSTRY OUTLOOK

The industry research publication titled 'India Oral Care Industry Outlook to 2018 - Driven by Premiumization of Toothpaste and Mouthwashes' presents a comprehensive analysis of market size by value of oral care products in India. The report entails the market share analysis and company profiles of major players in the toothpaste, toothbrush, mouthwash and other oral care products market. The future analysis and segmentation of oral care products (toothpaste, toothpowder, toothbrush, mouthwash, dental floss and oral care chewing gum) have also been discussed.

Indian oral care industry, over the last few years, has been one of the fast growing FMCG sectors. The oral care industry is segmented into five categories which include toothpaste, toothbrush, toothpowder, mouthwashes; others oral care products such as dental flosses and oral care chewing gum. The overall market for Indian oral care products has grown at CAGR of 14.4% during FY'2008-FY'2014. The growth in the industry is driven by rising disposable income, change in consumer lifestyle, entry of international players in the market and introduction of new product categories in toothpaste, toothbrush and mouthwashes.

Toothpowder category, on the other hand has demurred in the industry and in FY'2015. The decline in the toothpowder market revenue was mainly due to change in the consumer tastes and preferences towards easy to use oral care products in the market. Further, the mouthwashes segment has showcased high growth expansion in the Indian market. At present, the penetration percentage of mouthwashes is also in the single digit. The major players in the mouthwashes market are focusing on advance oral problem solution for the consumer in the market. For instance, Sensitive mouthwashes are offered by Colgate Palmolive India to address sensitive teeth.

The long term growth potential of the industry remains optimistic of oral care products. Increasing disposable earnings, growing lower and upper middle class, incline in the population demography, rising oral awareness, convenient oral care products, growing distribution chain and logistics storage, increasing toothpaste penetration, development in oral care solution segments and others are some of the factors expected to drive the industry's growth in the next five years.

The overall oral care industry in India is expected to grow significantly at a CAGR of 13.9% in the forecasted period of FY'2014-FY'2018.

VALUATION

COLGATE-PALMOLIVE is currently trading at 953 per share with a market capitalization of 127.86B. Company is debt free with is a confidence booster for long term investors. It gave compounded return of 27% since the IPO to its shareholders.

|

Valuation Measures |

|

|

Market Cap |

127.86B |

|

Enterprise Value |

125.26B |

|

Trailing P/E |

23.75 |

|

Forward P/E |

32.94 |

|

PEG Ratio |

2.5 |

|

Price/Sales |

3.17 |

|

Price/Book |

16.6 |

|

Enterprise Value/Revenue |

3.11 |

|

Enterprise Value/EBITDA |

15.06 |

We value COLGATE-PALMOLIVE using DCF at price target of 1083 for FY16 with expected growth rate at 13.25% per annum. For valuation we assume that over the period company will keep capital structure unaltered and tax rate unchanged.

|

|

Industry average |

Colgate-Palm. |

|

OPM % |

17.84 |

20.18 |

|

NPM % |

12.46 |

14.04 |

|

PE |

56.10 |

48.99 |

|

P/BV |

17.90 |

35.55 |

|

BV |

308.47 |

56.64 |

CONCUSSION AND RECOMMENDATION

Based on the strong product portfolio and geographically diversified presence, we value the stock at 48.5x FY16 EPS, which gives a target price of Rs 1083. We feel that investors could buy the stock at the CMP for the given target prices for FY16.

RISKS AND CONCERNS

-

Managing the price increase Inflation has direct impact on FMCG companies. Inflation is now stable because of falling crude prices. Any reverse in trend will have negative impact on margins.

-

Above this there is always promotional pressure because retailers and consumers often buy from one sales promotion to the next. This makes FMCG companies extra vulnerable, because missing out on a promotion directly hurts company’s turnover.

-

Royalty is one big concern Royalty has been expanding relentlessly, as a rate of offers, in the previous couple of years.

-

The rapidly developing markets and the Competition in the market is a major concern for Colgate.

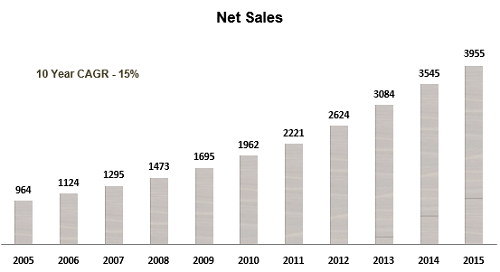

FINANCIALS

Colgate-Palmolive (India) Ltd., incorporated in the year 1937, is a Large Cap company (having a market cap of Rs 25524.49 Cr.) operating in Personal Care sector.

For the quarter ended 30-Jun-2015, the company has reported a Standalone sales of Rs. 1002.91 Cr., down -1.87% from last quarter Sales of Rs. 1022.00 Cr. and up 5.50% from last year same quarter Sales of Rs. 950.64 Cr. Company has reported net profit after tax of Rs. 114.28 Cr. in latest quarter.

Colgate-Palmolive (India) Ltd. key Products/Revenue Segments include

-

Soaps Cosmetics & Toilet Preparation which contributed Rs 3592.00 Cr to Sales Value (84.74% of Total Sales),

-

Brushes (Tooth & Shaving) which contributed Rs 617.08 Cr to Sales Value (14.55% of Total Sales),

-

Service Income which contributed Rs 24.84 Cr to Sales Value (0.58% of Total Sales),

-

Scrap which contributed Rs 2.33 Cr to Sales Value (0.05% of Total Sales),

-

Others which contributed Rs 2.12 Cr to Sales Value (0.05% of Total Sales) for the year ending 31-Mar-2015.

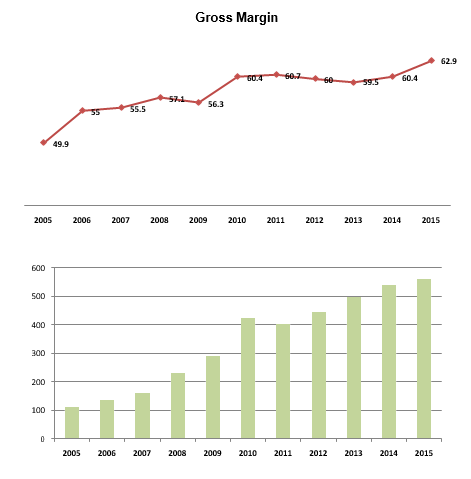

|

Net Sales |

|

|

2005 |

964 |

|

2006 |

1124 |

|

2007 |

1295 |

|

2008 |

1473 |

|

2009 |

1695 |

|

2010 |

1962 |

|

2011 |

2221 |

|

2012 |

2624 |

|

2013 |

3084 |

|

2014 |

3545 |

|

2015 |

3955 |

|

10 Year CAGR - 15% |

|

|

Income Statement Yearly |

2014 |

2015 |

2016 E |

2017 E |

|

Revenue |

3693.51 |

4015.11 |

4536.95 |

5130.38 |

|

Total Expenditure |

2914.8 |

3159.7 |

3524.80 |

3991.83 |

|

EBIDTA |

778.71 |

855.41 |

1012.15 |

1138.55 |

|

EBIT |

727.96 |

780.39 |

922.07 |

1036.61 |

|

PBT |

727.96 |

780.39 |

922.07 |

1036.61 |

|

Profit After Tax |

539.87 |

558.98 |

685.59 |

769.19 |

|

|

||||

|

Equity |

13.6 |

13.6 |

13.60 |

13.60 |

|

Face Value |

1 |

1 |

1.00 |

1.00 |

|

Outstanding Shares |

|

272 M |

272 M |

272 M |

|

EPS |

39.7 |

39.64 |

48.62 |

54.55 |

|

|

||||

|

EBIDTA M(%) |

21.76% |

21.48% |

22.47% |

22.34% |

|

EBIT M(%) |

20.34% |

19.60% |

20.47% |

20.34% |

|

PATM(%) |

13.32% |

13.92% |

15.11% |

14.99% |

Share Capital History

|

Year |

Issue |

Share(MM) |

Cumm(MM) |

|

1978 |

|

|

2 |

|

1982 |

Bonus 1:1 |

2 |

3.9 |

|

1985 |

Bonus 1:1 |

3.9 |

7.9 |

|

1987 |

Bonus 1:1 |

7.9 |

15.7 |

|

1989 |

Bonus 1:1 |

15.7 |

31.4 |

|

1991 |

Bonus 3:5 |

18.9 |

50.3 |

|

1993 |

Preferential issue to Colgate-Palmolive Company |

11.3 |

61.6 |

|

1994 |

Bonus 1:1 |

61.6 |

123.2 |

|

1994 |

Rights 1:10 |

12.3 |

135.5 |

|

1994 |

Preferential issue to Employees & Colgate-Palmolive Company |

0.5 |

136 |

|

2015 |

Bonus 1:1 |

|

|

The last bonus that Colgate Palmolive (India) had announced was in 2015 in the ratio of 1:1.The share has been quoting ex-bonus from September 23, 2015.

|

PAT |

|

|

2005 |

113 |

|

2006 |

138 |

|

2007 |

160 |

|

2008 |

232 |

|

2009 |

290 |

|

2010 |

423 |

|

2011 |

403 |

|

2012 |

446 |

|

2013 |

497 |

|

2014 |

540 |

|

2015 |

559 |

|

10 Yr CAGR - 17% |

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.