CANARA BANK

Canara Bank - Company Profile

Founded as 'Canara Bank Hindu Permanent Fund' in 1906, by late Shri Ammembal Subba Rao Pai, a philanthropist, this small seed blossomed into a limited company as 'Canara Bank Ltd.' in 1910 and became Canara Bank in 1969 after nationalization. Canara Bank is engaged in providing a wide range of banking and financial services in retail banking, wholesale banking and treasury operations.

For FY 2013, Canara Bank’s net interest margins stood at 2.39 % (2.50 % for FY 2012). Total deposits with the bank stood at Rs. 3, 55,856 Cr. growing by 9.8 % over the previous year. For the same period, net NPA’s stood at 2.18 % (1.46 % for FY 2012).

During FY 2013, the Bank has added 128 domestic branches and 668 ATMs. As of March 31, 2013,the Bank has 3,728 branches including 5 overseas branches and 3,525 ATMs.

The Bank’s CASA deposits to domestic deposits stood at 25.1%. The Bank’s clientele base reached 4.70 Cr., comprising 4.17 Cr. under deposit accounts and 53 lakh un- der borrowal accounts. 50 lakhs clientele added during the year.

Can fin homes has received regulator Sebi's approval for raising up to Rs 300 crore through a 'rights issue'. Sebi issued its final 'observations' on the draft offer documents on December 8, according to the latest update by the capital markets regulator.

Issuance of 'observations' on offer documents by Sebi is considered as a clearance to the issuer to go ahead with the share issues through routes like IPOs, FPOs and rights issue. Can Fin Homes, promoted by Canara bank, is primarily engaged in the business of housing finance. The company intends to utilise the net pro- ceeds towards "augmentation of capital base", which would result in an increase in networth and enable the company "to meet future capital adequacy require- ments".

At the end of June 30, 2014, Canara Bank had gross and net NPAs (Non-Performing Assets) of Rs 1,843.04 lakh and Rs 632.62 lakh respectively.

Canara Bank - STOCK INFORMATION

|

STOCK PRICE |

446.65 |

|

TARGET PRICE |

460-475 |

|

SECTOR |

BANK-PUBLIC SECTOR |

|

SYMBOL (AT NSE) |

CANBANK |

|

ISIN |

INE476A01014 |

|

FACE VALUE (IN RS.) |

10.00 |

|

BSE CODE |

532483 |

Canara Bank - STOCK FUNDAMENTALS

|

MARKET CAP |

20,639.03 |

|

BOOK VALUE |

642.16 |

|

EPS - (TTM) (IN RS. CR.) |

53.20 |

|

P/E |

8.41 |

|

INDUSTRY P/E |

12.31 |

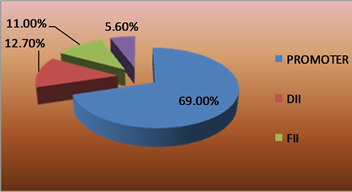

SHAREHOLDING PATTERN

RESULTS (Quarterly )(Rs CR.)

|

|

SEP' 14 |

JUN' 14 |

MAR' 14 |

DEC' 13 |

SEP' 13 |

|

Sales |

10,893.87 |

10,701.11 |

10,539.68 |

10,083.8 |

9,654.48 |

|

Operat- ing profit |

8,316.58 |

8,251.81 |

7,725.28 |

7,544.81 |

7,441.26 |

|

Interest |

8,526.08 |

8,271.85 |

8,004.49 |

7,856.88 |

7,463.32 |

|

Gross profit |

1,625.54 |

1,795.00 |

1,882.10 |

1,590.86 |

1,424.97 |

TECHNICAL VIEW

CANARA BANK is looking strong on charts. We advise to buy around 440-445 with stoploss of 425 for the targets of 460-475 levels. RSI is also showing upside momentum in it on daily charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

66.771 |

BUY |

|

STOCH(9,6) |

79.385 |

BUY |

|

STOCHRSI(14) |

86.374 |

OVERBOUGHT |

|

MACD(12,26) |

-11.070 |

SELL |

|

ADX(14) |

55.160 |

BUY |

|

WILLIAMS %R |

-4.702 |

OVERBOUGHT |

|

CCI(14) |

129.9617 |

BUY |

|

ATR(14) |

3.4357 |

LESS VOLATILITY |

|

HIGH/LOWS(14) |

4.8643 |

BUY |

|

ULTIMATE OSCILLATOR |

62.595 |

BUY |

|

ROC |

3.666 |

BUY |

|

BULL/BEAR POWER()13 |

9.7160 |

BUY |

|

BUY: 8 SELL:1 NEUTRAL: 2 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

UNION BANK |

BUY |

239.00 |

230-235 |

230 |

242-248 |

ONE WEEK |

|

RCOM |

SELL |

81.30 |

83-85 |

88 |

81-78 |

ONE WEEK |

|

VOLTAS |

SELL |

240.05 |

244-246 |

250 |

234-224 |

ONE WEEK |

|

ALLAHABAD BANK |

BUY |

131.60 |

128-130 |

125 |

134-138 |

ONE WEEK |

|

ARVIND |

BUY |

280.35 |

277- 280 |

274 |

284-288 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE / LOW/ HIGH

|

|

HCL TECH |

125 |

BUY |

1560-1590 |

1520 |

1630-1650 |

-5000.00 |

SL TRG |

1565.80 / 1503.05 |

|

HEXAWARE |

2000 |

BUY |

200-202 |

197 |

205-208 |

-6000.00 |

SL TRG |

198.40 / 192.30 |

|

JSW ENERGY |

4000 |

BUY |

101-102 |

98 |

104-107 |

12000.00 |

FIRST TGT HIT |

102.25 / 105.20 |

|

KPIT TECH |

1000 |

BUY |

202-205 |

192 |

212-222 |

6000.00 |

NEAR TGT |

197.00 / 211.40 |

|

GLENMARK |

500 |

SELL |

760-780 |

800 |

740-720 |

-10000.00 |

SL TRG |

136.20 / 130.25 |

|

KOTAK BANK |

250 |

SELL |

1240-1250 |

1280 |

1210-1200 |

3500.00 |

NEAR TGT |

1264.65 / 1236.25 |

|

NET PROFIT |

|

|

|

|

|

500.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.