Apcotex Industries

Apcotex Industries Limited - Background

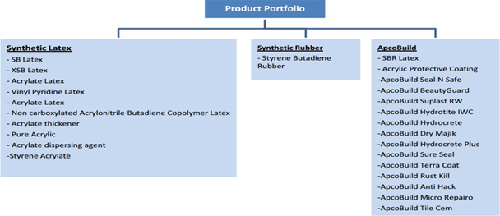

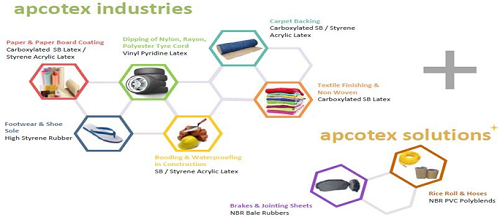

Apcotex Industries Limited is engaged in the production of polymer products namely, synthetic latexes (vinyl pyridine latex, carboxylated styrene-butadiene latex, styrene-acrylic latex, and nitrile latex, among others) and synthetic rubber (high styrene rubber). The Company offers a range of products in the industrial segments and caters to an array of industries. The Company's synthetic latexes products are used, among other applications, for tire cord dipping, paper and paperboard coating, carpet backing, concrete modification/waterproofing, non-woven, textile finishing, and paints. Its various grades of synthetic rubber find application in products, such as footwear, automotive components, molded items, v-belts, conveyor belts, and hoses. The Company's core raw materials are petrochemical products. The Company's operations are managed from India. The principal geographical areas in which the Company operates are India, the Middle East, and Asian Countries. Source: Reuters

|

BSE Code |

523694 |

|

NSE Code |

APCOTEXIND |

|

Reuters Code |

APCI.NS |

|

CMP (as on 09/06/2016) |

373.00 |

|

Stock Beta |

1.58 |

|

52 Week H/L |

398.00/181.38 |

|

Market Cap (Cr) |

775.81 |

|

Equity Capital (Rs cr) |

10.41 |

|

Face Value (Rs) |

5 |

|

Average Volume |

196.84 |

|

|

|

|

Shareholding Pattern (%) |

|

|

Promoters |

57.60 |

|

Non Institutions |

42.40 |

|

Grand Total |

100 |

Apcotex Industries Limited - Investment Rationale

-

Capacity utilization and capex to drive topline

-

Niche category ensures pricing power and revenue growth visibility

-

GST to improve consumption

-

Acquisition of OMNOVA provides a new dimension

-

Strong client base

Apcotex Industries Limited - Risks and Concerns

-

Competition from the unorganized sector

-

Changes in manufacturing cost

-

Maintenance shutdown

Conclusion & Recommendation

Apotex is a dominant player in the rubber polymer industry with vast experience, dominant market share in an industry with high entry barriers. With the acquisition of OMNOVA Apcotex will be able to increase its technical know-how and product offering in a significant manner. The strong client base and implementation of GST will increase the consumption of its products and provide a vast opportunities to grow in the niche product segment. We expect the company to outperform its peers in the medium and long term.

At the current market price of Rs.373, the stock is trading at ~12x FY18E EPS. Investors could buy the stock at CMP and add on dips to around Rs.340 to Rs.330 levels (~11x FY18E EPS) for our sequential targets of Rs.460 and Rs.500 (~15x to ~16x FY18E EPS).

Apcotex Industries Limited - Financial Summary

|

Particulars (Rs. in Crs) |

FY14 |

FY15 |

FY16 |

FY17E |

FY18E |

|

Net Sales |

330.35 |

391.14 |

294.93 |

445.34 |

605.67 |

|

Operating Profit |

27.56 |

47.05 |

47.70 |

75.09 |

106.10 |

|

PAT |

13.14 |

24.68 |

38.53 |

43.58 |

64.78 |

|

EPS (Rs.) |

6.31 |

11.85 |

18.51 |

20.93 |

31.11 |

|

PE |

59.10 |

31.47 |

20.16 |

17.82 |

11.99 |

Apcotex Industries Limited - Company Profile

About Apcotex Industries Apcotex has developed a strong R&D base, which has enabled it to develop, manufacture, and export products and competes against global players such as BASF and Dow Chemicals. Apotex was started as a division of Asian Paints in 1980. It was spun off as a separate company in 1991 as Apcotex Lattices Ltd. It changed its name from "Apcotex Lattices Ltd" to "Apcotex Industries Ltd" in June 2005. Apotex Industries is one of the leading producers of performance emulsion polymers in India. Its manufacturing facility is at Taloja, 25 kilometers from Mumbai. Its product range includes VP latex, carboxylated and non‐carboxylated SB latexes, acrylic latex, nitrile latex, and synthetic rubber. Its latex product range is used for paper/board coating, carpet backing, concrete (concrete modification, waterproofing), tire, paint, textile finishing, and automotive components. Its synthetic rubber product range is used for footwear and other products. It has an ISO certification and has received several awards for manufacturing.

In the last few years, it has developed a strong R&D base, which has enabled it to develop, manufacture, and export products and competes against global players such as BASF and Dow Chemicals. It provides value‐added services through which customers can improve the quality of their final product using Apcotex’s service team and application laboratory. The value‐added service is a major differentiating factor for the company in the specialty chemicals industry. It was the first company to start making vinyl pyridine latex in India, an important raw material for the tire industry. It was the first company to start making vinyl pyridine latex in India, an important raw material for the tyre industry. Later, it also developed products such as carboxylated‐ styrene‐butadiene latexes, synthetic rubbers, and acrylic latexes, in‐house. Recently, it has introduced a range of acrylics products for paper, construction, and carpets. It also sells different types of protective coating agents under the brand name ApcoBuild.

It faces major risks in sourcing two main raw materials — styrene and butadiene, downstream petro‐chemical products. Styrene is not manufactured in India, so the company imports it. Butadiene has only two manufacturers in the country, Indian Oil Corporation and Reliance Industries. Since hedging instruments are not available, it is vulnerable to raw‐material availability and price volatility. The company manages its availability risk by monitoring overseas supplies and varying its inventory levels. It also faces materials‐management risk, as some of its raw materials are hazardous and inflammable. However, it has the required safety equipment and infrastructure in place (as per statutes and global safety standards).

Investment Rationale

Capacity utilization and capex to drive topline

The current capacity utilization levels stands at ~75% on a consolidated level. Omnova’s plant’s capacity is 20,000 tonnes and it is based in Valia, Gujarat. With the acquisition, Apcotex gets 115 acres of land, which provides significant opportunities for future brownfield expansions. It currently has an annual installed capacity of 55,000 tonnes with 40,000 tonnes in latex and 15,000 tonnes in rubber. It also plans to invest ~Rs.25 – 30 crores for upgrading the technology mostly for new product launches and value added products. Apcotex can increase its production higher without any capex requirement when the demand for its products picks up.

GST to improve consumption

The goods and services tax (GST) is being talked about as the single most powerful tax reform that India will see. The objective is to end the regime of multiple taxes on goods and services and bring them under one rate. The system will change from the current production-based taxation to being consumption-based. Along with bringing about a semblance of uniformity in taxes across states, this is expected to increase efficiency and compliance in the system. For manufactured consumer goods, the current tax regime means the consumer pays approximately 25-26% more than the cost of production due to excise duty (peak of about 12.5%) and value-added tax. While there hasn’t been any indication of a GST rate, experts suggest between 18% and 22%. Given this, basic goods are likely to become marginally cheaper. There is no doubt that in the production and distribution of goods, services are increasingly used or consumed and vice versa. Unorganized players are currently out of the tax net and thus enjoy lower costs by evading taxes. After the introduction of GST, the tax advantage enjoyed by the unorganized players would diminish sharply and the market share of the organized players is likely to increase significantly, benefiting big name listed players. The organized sector would gain market share from unorganized players due to a shift in consumer preference for quality retreading products. Also, implementation of the GST, going forward, could reduce the pricing gap between organized and unorganized players, thereby rendering the organized players' pricing equally attractive which adds to the growth potential of the company.

Acquisition of OMNOVA provides a new dimension

Apotex acquired has acquired a 100% stake in Omnova Solutions India Pvt Ltd (OSIPL) on 5th February 2016, the Indian arm of US-based specialty company Omnova Solutions Inc, for | 36 crores. This is aligned with Apcotex’s long-term strategy to tap the full potential of the emulsion polymers industry, through organic and inorganic growth. Omnova Solutions is a manufacturer of emulsion polymers such as nitrile rubber (NRB), nitrile powder, nitrile/PVC blends, and high-styrene rubber. Apotex already has a presence and market leadership in emulsion polymer categories such as VP latex, CB latex, nitrile latex, and synthetic rubber. Omnova has a reasonable market share of ~20% in nitrile products. In styrene rubber, the acquisition will provide Apcotex with a near-monopoly position in the Indian market. The acquisition has helped us expand our product range by adding Nitrile Rubber, Nitrile Powder, and Nitrile Polyblends into our product basket. It has helped us enter into new industries that we were not previously in; such as Automotive Components and Rice Rolls and we have been able to acquire some new technologies that earlier we did not have, like powder manufacturing and Monomer Recovery processes. Its acquisition broadens the technological expertise (which provides long-term advantages to scale the business) apart from a significant improvement in product range and expansion of client base. it also provides apcotex to cross-sell its products through its already established network, which enables the company to have further room for growth through its already existing network. The acquisition will also lead to higher operational leverage, manufacturing and process synergies, common clients; working capital efficiency, etc will result in an increase in margins of Omnova.

Strong client base

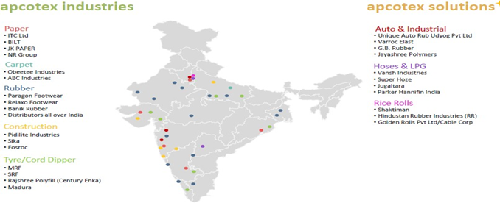

Apotex products are very critical to user industries. In essence, they are performance or specialty chemicals. For instance, the overall latex cost is less than 1% of the cost of manufacturing tires. But it is a critical requirement. The main customers are Apollo Tyres, Birla Tyres, Continental Modi Tyres, MRF, SRF, and Century Enka in the tire and cord dipper industry; ITC, Bilt, JK Paper, and the NR Group in the paper and paper board segment; Paragon Footwear, Relaxo Footwear, and Banik Rubber in the rubber sector; Pidilite Industries, Sika and Fosroc in the construction industry; and Obeetee Industries and ABC Industries in the carpet segment. The average customer approval cycle is from 6m to 3yrs, which ensures strong revenue visibility for Arcotex. With the growth prospects of the end-user industry and the company looking bright, Apotex will be a key beneficiary.

Niche category ensures pricing power and revenue growth visibility

Apotex is one of the leading producers of Performance Emulsion Polymers in India. Its product range includes VP latex, Carboxylated and Non-Carboxylated SB latexes, Acrylic latexes, Nitrile latex, and Synthetic Rubber. Its range of Latexes is used, among other applications, for Tyre Cord Dipping, Paper/Board Coating, Carpet Backing, Construction (Concrete Modification, Water Proofing, etc.), Paints, Textile Finishing and Automotive Components. Apotex's High Styrene Synthetic Rubber finds applications in footwear, automotive components, v-belts, conveyor belts, and hoses. Apotex operates in the niche category of specialty chemicals used in paper, tires, construction, carpets, synthetic rubber, and paints. In these segments, it is the largest or second‐largest player with ~21% dominant market shares. The Indian specialty chemicals market is fragmented with 700 players and top‐20 companies contributing only 48% of the sector’s revenues. Chemicals are one of the largest sectors in the world. The specialty chemicals industry has high growth rates and steep entry barriers, which translates into lower competitive intensity. Apotex being a dominant player is expected to benefit from the same.

Stable raw materials cost leads reduce downside margins risk

The Company’s major raw materials are petrochemical products namely Styrene and Butadiene and its business is vulnerable to high volatility in the prices of crude oil and its downstream products. This financial year the lower prices of crude oil and downstream petrochemicals were advantageous to the company since most input material costs decreased significantly towards the second half of the year. The Company was able to manage inventories well and secure good prices on input materials. The forecasted crude oil prices are expected to be under 55 dollars, which will help Apcotex to maintain steady margins.

Export potential

Apotex has a strong global presence in South East Asia, the Middle East & Africa and intends to tap the Asian Markets. Exports continue to be around 18-20% of total sales. The company aims to be the market leader in exports to neighboring countries like Bangladesh, Bhutan, Sri Lanka, etc. With the environmental laws getting strict in the majority of the chemical manufacturing countries, especially in China: Apcotex with its high-end technology and capacities will be a key contender to benefit from the increase in international demand.

Industry Profile

The chemical industry is central to the modern world economy having a typical sales-to-GDP ratio of 5-6%. Global chemical production growth slowed down from 4.4% p.a. in 1999-2004 to 3.6% p.a. in 2004-2009, with global chemical sales in FY10 valued at $3.4 trillion. The global chemicals industry is witnessing a gradual eastward shift. The industry is increasingly moving eastwards in line with the shift of its key consumer industries (e.g. automotive, electronics, etc.) to leverage greater manufacturing competitiveness of emerging Asian economies and to serve the increasing local demand. Over the last 10 years, the share of Asia in global chemical sales has increased by ~14% points rising from 31% in 1999 to 45% in 2009. With rising concerns around climate change and depleting natural resources, focus on sustainability is another key trend impacting the global chemical industry. Chemical companies are increasingly working towards reducing the energy intensity of their operations, minimizing effluent discharge and pollution, increasing the share of recyclable products in their portfolio, and diversifying their raw material base to include bio-feedstock.

With Asia’s growing contribution to the global chemical industry, India emerges as one of the focus destinations for chemical companies worldwide. With the current size of $108 billion, the Indian chemical industry accounts for approximately 7% of Indian GDP. The chemicals sector accounts for about 14% of the overall index of industrial production (IP). The share of industry in national exports is around 11%. In terms of volume, India is the third-largest producer of chemicals in Asia, after China and Japan. Despite its large size and significant GDP contribution, the Indian chemicals industry represents only around 3% of global chemicals.

Two distinct scenarios for the future of the Indian chemical industry emerge, based on how effectively the industry leverages its strengths and manages challenges. In the base case scenario, with current initiatives of industry & government, the Indian chemical industry could grow at 11% p.a. to reach the size of $224 billion by 2017. However, the industry could aspire to grow much more and its growth potential is limited only by its aspirations. In an optimistic scenario, high end-use demand based on increasing per capita consumption, improved export competitiveness, and resultant growth impact for each sub-sector of the chemical industry could lead to an overall growth rate greater than 15% p.a. and size of $ 290 billion by 2017.

Demand for basic organic chemicals has a potential to grow at 10% p.a. to reach 5 million tonnes by end of the XIIth plan period. To cater to this demand and move towards self-sufficiency, the organic chemical industry must target growth of 10-12% p.a. during the XIIth plan period. To cater to this demand the industry may target increasing its acetic acid capacity by 450,000 (current capacity 351,000 tonnes) tonnes to bring down the demand-capacity deficit from 41% to 20%. Methanol presents an opportunity of over 2 million tonnes of capacity requiring an investment of approximately $0.9 billion (Rs.4,000 Crore). Phenol's capacity target for the end of the XIIth plan period could be a total of 200,000 tonnes (from the current capacity of 74,000 tonnes) to bring down the demand-capacity gap from 68% to 40%.

Compared to the developed world (the US, Europe) or China, the current penetration of specialty chemicals within India’s end markets is low. With an increased focus on improving products, the usage intensity of specialty chemicals within these end markets will rise in India over the next decade. For example, concrete admixtures improve the fluidity of concrete, provide a smoother, more even finish, and help avoid cracks. Consequently, concrete admixtures can help reduce maintenance and repair costs, and therefore, the total cost of ownership of construction projects in India. India’s current expenditure on admixtures is only $ 1/ m3of concrete, compared to $ 2/ m3 in China and $ 4.5/ m3 in the US. This is primarily due to the lack of awareness of admixtures in the Indian construction industry. With the increasing demand for higher quality construction and increasing awareness of concrete admixture benefits, the industry could double the intensity of admixture consumption in India.

There is a global demand for Indian chemical products due to their high quality and competitive pricing. India’s expertise in developing low-cost yet high-end chemical products is the key growth driver for Indian chemical exports.

Risks and Concerns

Competition from the unorganized sector

There is a large number of unorganized players in the chemical industry market delivering products at different standards. Amtek is exposed to high completion from these players both in domestic and international markets.

Changes in manufacturing cost

The cost of production of its different products makes the maximum share of its expenses. The increase in the price of raw materials and labor costs can affect the profit margin of the company.

Maintenance shutdown

The high Styrene Rubber plant at Tajola will be closed for three to four months in FY17 for repair works. This shutdown can adversely affect the production and stocking of the company.

Financials

Profit and Loss Account (as per rough estimates)

|

|

FY14 |

FY15 |

FY16 |

FY17E |

FY18E |

|

Gross Sales |

330.35 |

391.14 |

294.93 |

445.34 |

605.67 |

|

Excise Duty |

34.98 |

37.78 |

0 |

0 |

0 |

|

Net Sales |

295.38 |

353.37 |

294.93 |

445.34 |

605.67 |

|

Other Operating Income |

1.65 |

1.71 |

1.53 |

1.51 |

1.45 |

|

Other Income |

2.43 |

5.58 |

8.28 |

9.01 |

10.77 |

|

Total Income |

299.47 |

360.66 |

304.74 |

455.86 |

617.89 |

|

Total Expenditure |

271.9 |

313.61 |

257.03 |

380.77 |

511.79 |

|

PBIDT |

27.56 |

47.05 |

47.7 |

75.09 |

106.10 |

|

Interest |

4.14 |

3.24 |

2.43 |

2.69 |

2.54 |

|

PBDT |

23.42 |

43.81 |

45.27 |

72.40 |

103.57 |

|

Depreciation |

6.77 |

8.98 |

9.4 |

11.01 |

12.33 |

|

PBT |

16.65 |

34.83 |

35.88 |

61.38 |

91.24 |

|

Tax |

3.51 |

10.15 |

-2.65 |

17.80 |

26.46 |

|

Reported Profit After Tax |

13.14 |

24.68 |

38.53 |

43.58 |

64.78 |

|

Extra-ordinary Items |

0 |

0 |

0 |

0 |

0 |

|

Adj Profit After Extra-ordinary item |

13.14 |

24.68 |

38.53 |

43.58 |

64.78 |

|

|

|

|

|

|

|

|

PBIDTM(%) |

9.33 |

13.31 |

16.78 |

16.47 |

17.17 |

|

PBDTM(%) |

7.93 |

12.4 |

15.87 |

15.88 |

16.76 |

|

PATM(%) |

4.45 |

6.98 |

9.24 |

9.56 |

10.48 |

Balance Sheet (as per rough estimates)

|

|

FY14 |

FY15 |

FY16 |

FY17E |

FY18E |

|

SOURCES OF FUNDS: |

|

|

|

|

|

|

Share Capital |

5.22 |

5.22 |

10.41 |

10.41 |

10.41 |

|

Reserves & Surplus |

80.05 |

94.53 |

176.81 |

206.81 |

248.81 |

|

Loan Funds |

39.64 |

22.76 |

17.05 |

17.05 |

17.05 |

|

Deferred Tax Liability |

6.38 |

5.59 |

0 |

0.00 |

0.00 |

|

Other Liabilities |

2.66 |

3.11 |

3.37 |

3.72 |

4.07 |

|

Total Liabilities |

133.96 |

131.2 |

207.64 |

237.99 |

280.34 |

|

APPLICATION OF FUNDS: |

|

|

|

|

|

|

Fixed Assets |

68.92 |

65.13 |

94.74 |

92.56 |

98.33 |

|

Investments |

24.45 |

30.76 |

17.81 |

23.71 |

23.81 |

|

Current Assets, Loans & Advances |

82.35 |

78.2 |

152.11 |

174.91 |

210.40 |

|

Inventories |

17.1 |

15.22 |

43.34 |

56.36 |

76.08 |

|

Sundry Debtors |

51.71 |

48.7 |

83.84 |

89.55 |

99.61 |

|

Cash & Bank Balance |

6.12 |

4.43 |

9.81 |

10.48 |

12.32 |

|

Other Current Assets |

3.7 |

4.37 |

7.72 |

9.71 |

11.98 |

|

Loans & Advances |

3.72 |

5.47 |

7.41 |

8.82 |

10.42 |

|

Current Liabilities & Provisions |

49.42 |

49.46 |

80.42 |

79.22 |

82.75 |

|

Current Liabilities |

42.19 |

40.12 |

65.98 |

67.03 |

69.79 |

|

Provisions |

7.23 |

9.34 |

14.44 |

12.19 |

12.96 |

|

Net Current Assets |

32.93 |

28.74 |

71.69 |

95.69 |

127.65 |

|

Deferred Tax Assets |

0 |

0 |

6.73 |

6.73 |

6.73 |

|

Other Assets |

7.66 |

6.57 |

16.67 |

19.31 |

23.82 |

|

Total Assets |

133.96 |

131.2 |

207.64 |

237.99 |

280.34 |

Conclusion and Recommendation

We are positive on APCOTEX over the long term and hence recommend a BUY at CMP of RS.373.00 and further add on declines between Rs.340 to Rs.330 for a target of Rs.460 to Rs.500 with stop loss maintained at Rs.299.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.